“Patience Is a Virtue.”

“Good Things Come to Those Who Wait.”

– English Poets, William Langland and Lady Curie, respectively

The first five months of 2022 have no doubt tried the patience of all investors. We know the fundamentals of our economy remain solid overall with extremely low levels of unemployment, corporate earnings are quite solid and almost 80% of the time the U.S. stock market rises. We also know that the market doesn’t always provide instant gratification. Further, it is a given that investors worry during times of transition when monetary policy is evolving and key elements of the economy are shifting gears. Simply put, investors don’t like change, even if it is reasonable change accompanied by risks that are quite manageable. The transitions include shifts from:

- Accommodative to more normal Federal Reserve (Fed) policy

- A low-inflation/disinflationary environment to a higher level of annual price increases going forward (far lower than at present but above that seen over the last 20 years).

- Relative peace and stability among the major powers of the world to heightened geopolitical uncertainty

- Global pandemic to some sort of endemic

All these have made investors crabby in the early goings of 2022. If the famous American Revolutionary activist and brilliant writer Thomas Paine were alive to describe the first four and a half months of the S&P 500’s journey in 2022, he might be moved to resurrect his often-repeated phrase, “These are the times that try men’s souls.” During the period that took us through mid-May, the S&P 500 approached the threshold of what many call bear market territory. Specifically, on May 20, the large-cap U.S. stock index had declined over 20% year to date on an intraday basis. It was only a rally at day’s end that allowed the market to close down only -18.1% for the year and prevent it from breaching the -20% bear market threshold. 1

At times like these, patience is critical, and, as cited above, it can be a true virtue. In searching online for the elements of patience that make it so important and relevant to an investor, one finds that patience allows you to persevere and make more productive decisions, often leading to greater long-term success. It enables one to analyze situations beyond face value.

We have suggested for some time a meaningful correction was likely ahead. While it has been impossible to predict the exact timing of the correction, we previously urged clients to pare back to their normal, long-term strategic allocation in stocks if the unusually robust gains over the last three years had led to positive drift and a higher-than-normal weight of equities in their portfolio. In the face of the current correction, we are encouraging clients to be patient and “hold your ground.” Further, we’ve stated that we would not recommend selling below normal targeted levels. At the same time, we feel it is still premature to “buy on the dips.” Other adjustments in positioning are discussed below, but the bottom line is: We have maintained a positive, overall view on U.S. stocks and believe, via our disciplined research, the economy will not dissolve into recession in the near term. We have been clear that we expect stocks to be comfortably higher nine to 12 months from now, quite likely above the 4760 level at which the S&P 500 closed on Dec. 31, 2021, and well above the 4100 level at present. 2

Our patience and confidence emanate from the facts. The fundamental metrics of our economy and earnings growth remain positive. Valuation of U.S. stocks has fallen considerably from over 22 times earnings going into 2022 to less than 18 times at this writing. 3 Many stocks with strong balance sheets and attractive business models are trading well below these average valuation levels; therefore, we feel it is an ideal time to include active managers of individual stocks in one’s portfolio to complement the passive or index-oriented holdings you maintain. Couple this data with oversold technical conditions and the bearish investor sentiment in stock land (a positive, contrarian indicator), and this could be an excellent environment for stocks to advance from these levels. As you will see below, however, we still find it premature to buy on the dips just yet and to attempt to add back to your equity exposure in any meaningful way, as things could get a bit more oversold from here before we bottom; this is based on observations of historical low points. Our conclusion is to be patient and hold your ground!

The Risk of Whiplash

One of our most important cautionary points we are stressing with investors is not to become overly skeptical at this juncture. In addition to the supportive fundamental, valuation and technical price trend data we cite above, none of the three major signals of recession we monitor—shape of the yield curve, purchasing managers reports of manufacturing and service companies and trends in the Leading Economic Indicators (LEI index)—are flashing red. More important data will be released soon, but all appears healthy at this point. Noting these facts, we believe the risk of becoming uber-negative at present is the potential whiplash one could experience from selling their positions… think of the whiplash of the December 2018 or March 2020 variety. If investors sold back then after suffering the 21% December 2018 decline or the 35% March 2020 decline, they lost out on robust gains that quickly followed and took the S&P 500 to new highs in the blink of an eye. It might not happen as fast this time, but we think whiplash is a significant risk at this juncture. The market appears to us to be poised to rally on any news that inflation is getting “less worse” or that Fed policy adjustments will not lead to worst-case outcomes regarding how high interest rates rise. Same holds true if we experience any better than currently feared outcome in Ukraine. The market already knows this news is unnerving; it doesn’t trade on absolute conditions that are already known to be challenging, but rather trades on the trend in those conditions. We believe the foundation is healthier than appreciated and that the trends are gradually improving.

Signs of Green Shoots in May?

The performance of the market in the final days of May illustrates the whiplash that can result from jumping to the negative side too quickly. The market staged a handsome rally in May’s final week and enabled investors to leave for the Memorial Day weekend in a better mood. Specifically, both the S&P 500 and the tech-laden Nasdaq surged over 6% and posted by far their best week of performance for the year. 4 This very profitable week for the S&P 500 broke a six-week consecutive losing streak it had suffered. The rally was broad based, with all 11 S&P 500 industry sectors rising. 5 This was nice to see, but it must leave investors feeling a bit off balance as the significant price swings continue. One positive takeaway from a trend perspective is that this end-of-month rally was driven by some good data that was released in the couple of days leading into the long weekend:

- The Commerce Department revealed that U.S. personal income as well as consumer spending grew at a brisk pace through the first four months of 2022. 6

- The key inflation metric that the Fed focuses on—the PCE (personal consumption expenditure) deflator—fell to 4.9% from 5.2% on a yearly basis through April. While one month a trend does not make, this is an early sign that inflation is peaking. 7

- There were a number of retail companies—Nordstrom and Macy’s among them—that reported quarterly earnings last week, and their news supported the fact that U.S. consumers remain financially healthy and willing to spend. The earnings releases in retail land seemed to support the thesis that spending patterns might be changing, but not spending levels. If you recall, it was Target’s earnings release on May 17 that spooked investors and sparked the 4% decline in the market that day. To us, this was a misguided reaction to the Target data. Folks seemed to interpret the markdowns Target took on merchandise as a sign that the U.S. consumer was running out of gas. Quite the contrary… what the data seemed to be saying, in our view, was that Target just temporarily held the wrong merchandise. For example, their luggage sales were up more than 50% and their sales of apparel items grew at a brisk pace as U.S. consumers ramped up travel, restaurant dining and plans to return to the office. Conversely, their Covid-related, cocooning product category sales, such as electronics, fell. They stocked up too much on the latter and not enough on the former. This is a company-specific issue that can be corrected, not an indictment of the health of the U.S. consumer, as the market seemed to conclude after the Target report. This more mature view of the U.S. consumer’s health was supported by details in the earnings reports of the other department store and specialty retailers that released their quarterly “report cards” last week.

- The Atlanta Fed gross domestic product forecast for Q2 was modestly but positively revised up from 1.8% to 1.9%, and positive revisions were made to the Q1 data that was reported earlier; in particular, consumer and business investment spending look solid. 8

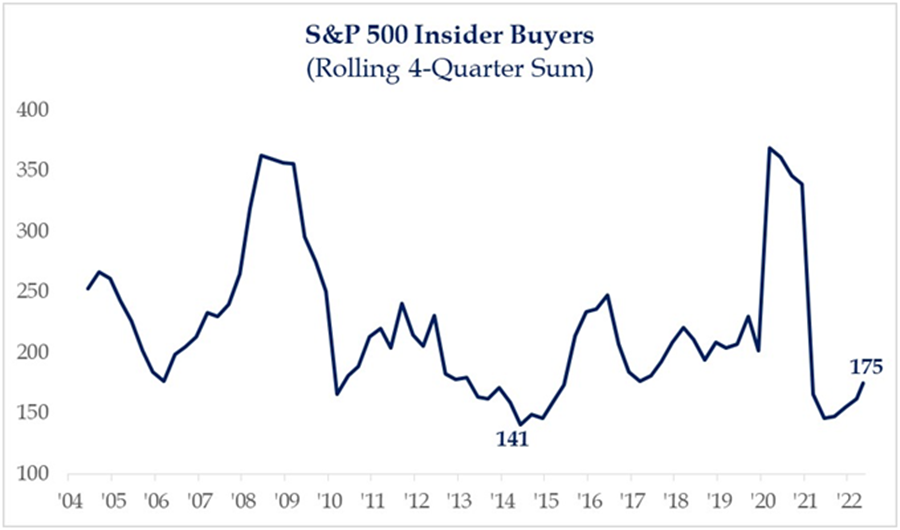

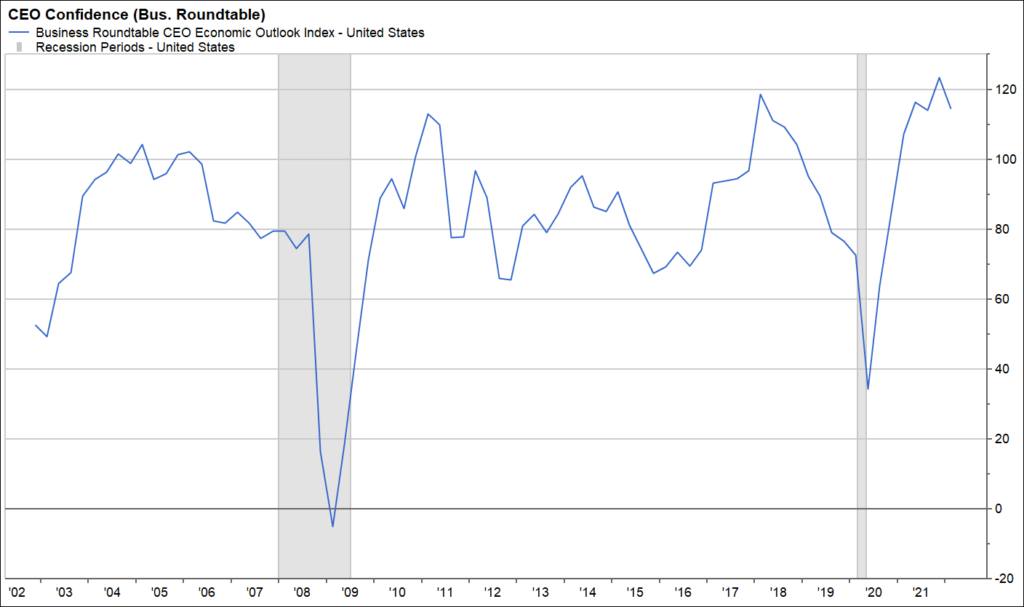

- CEO confidence remains strong, with reports of notable insider buying of stocks in the companies they run.

Source: Strategas

Source: FactSet

Time to Buy on the Dip?

So, given this solid run in the market last week, is this an all-clear sign or signal to “buy on the dip”? We still find it premature to make such a call. As stated earlier, we remain in the “hold your ground” camp. To become more aggressive in our message, we are looking for:

1. More sustained investor confidence that inflation is indeed peaking and starting to ease a bit, giving the Fed cover to soften its peak target on rate increases from levels investors fear right now.

2. Continued confirmation that economic growth is just slowing, not imploding.

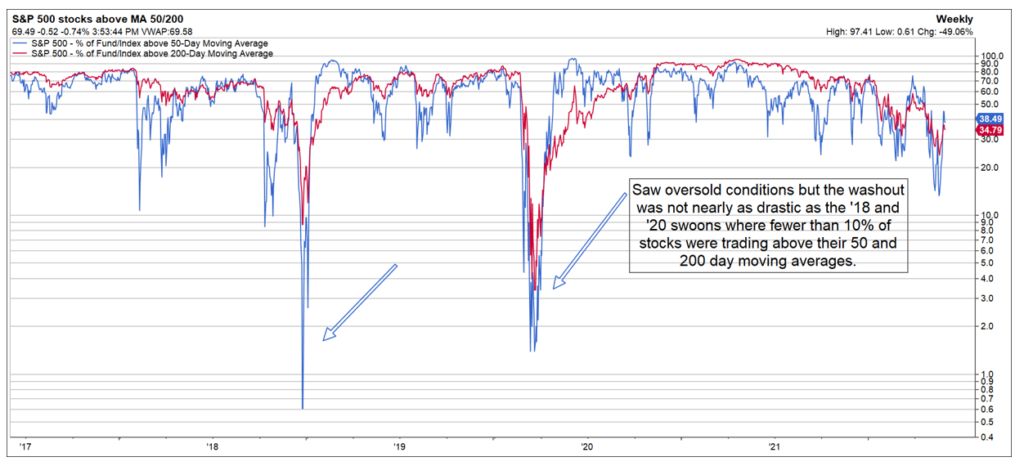

3. A bit stronger and more sustained momentum in the S&P 500 on up days in the market. Stocks are down in healthy measure so far this year, but still not at typical oversold levels (based on the percentage of stocks trading above their 50-day and 200-day moving average—see charts below).

Source: FactSet

Wrap Up

In conclusion, we are glad our message has been to reduce your stock allocation to your long-term strategic target if the strong returns in the S&P 500 over the last three years had taken it to above-average levels. This should give investors the courage and confidence to add to equities at the appropriate time if their allocation has fallen below their long-term target in this correction. We believe we are approaching the bottom and expect the market to trade at higher levels in the next nine to 12 months as the market successfully muscles through the headline concerns and gets comfortable that worst-case outcomes are not in the offing. At that point, investors should be able to once again focus on the attractive fundamentals and valuation levels, and P/Es should expand from there.

As the character Chauncey Gardiner, portrayed by Peter Sellers in the classic film “Being There,” said when asked if policy incentives could stimulate growth in the economy, “As long as the roots are not severed, all is well. And all will be well in the garden.” We agree that the roots have not been severed, but investors are behaving as though they have been. When we see confirmation of the three conditions listed above, we are ready to capitalize on this sell-off.

Stay tuned—and thanks for your confidence in us!

Sources:

1 FactSet

2 FactSet

3 FactSet

4 FactSet

5 FactSet

6Personal Income and Outlays, April 2022

7Personal Income and Outlays, April 2022

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange.

Indexes are unmanaged and cannot be directly invested into. Investing in securities involves risk, including loss of principal.

The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty. This commentary is limited to the dissemination of general information pertaining to Mariner Platform Solutions’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Disclosures:

The views expressed herein are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. Mariner Platform Solutions, LLC (“MPS”) is an SEC registered investment adviser. Registration of an investment adviser does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon SEC registered investment advisers by those states in which MPS maintains clients. MPS may only transact business in those states in which it is notice filed or qualifies for an exemption or exclusion from notice filing requirements. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.