Whether it is a trip to the store, booking a vacation, buying a car, or paying the utility bill, inflation has become front of mind. To fight rising costs, the Federal Reserve has hiked short-term interest rates at an historically unprecedented pace, with the effective Federal Funds rate rising from 0.20% as of March 1, 2022 to 4.58% on March 17, 2023.¹ While higher short-term interest rates have negative implications for borrowers, there are positive aspects for savers and investors.

Long-term, assets such as stocks, fixed income and real estate have provided far superior returns in comparison to cash. And over the last decade, extremely low yields on cash have led many, if not most, investors to cease thinking of cash as an asset class to be managed. However, the new higher interest rate environment provides investors incentive to be more thoughtful about their cash management strategy.

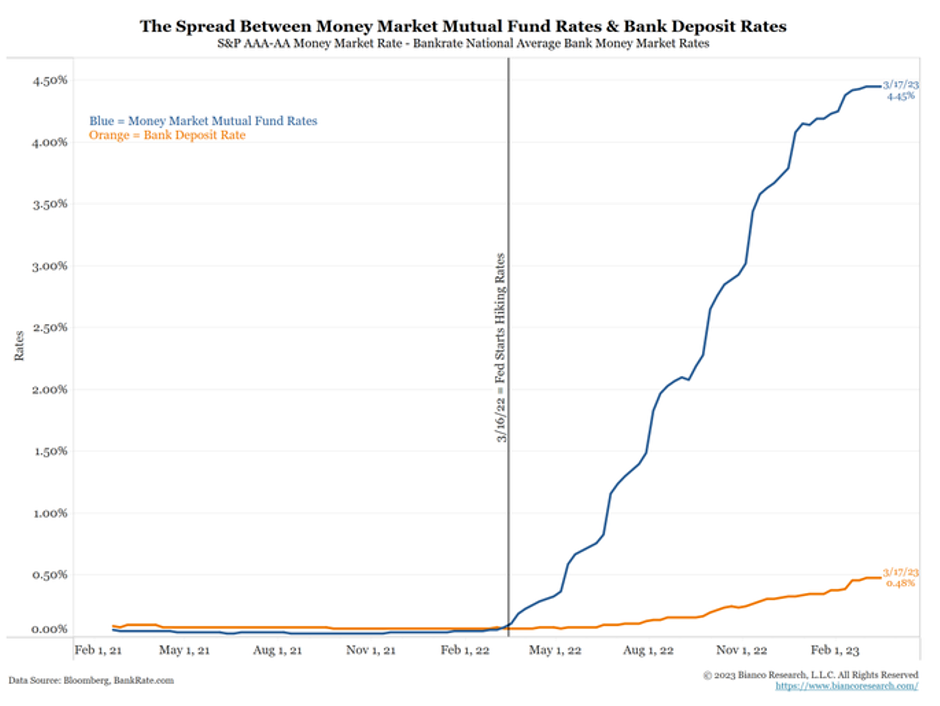

According to FDIC data, as of February 23, 2023 the national average interest rate for savings accounts stood at a paltry 0.35% APY, with the average for checking accounts even lower at 0.06% APY.2 These yields are far below both inflation and rates currently available on short-term fixed income vehicles. But with most banks generally flush with deposits and their customers only slowly moving towards other higher yielding cash options, banks have been slow to increase deposit rates. This puts the onus on investors and their financial advisors to seek out better cash management options.

Cash Management Options

Depending on one’s objectives, there are multiple cash management strategies available for investors. In choosing among these options, considerations for the investor include not only yield, but also liquidity, FDIC or SIPC insurance protection, and tax treatment.

- Paying down higher rate debt. Interest rates charged on lines of credit, margin loans, and credit card debt have increased significantly over the past year to levels well above yields on cash or cash equivalents. For those with such debt, paying it down is probably the best use of any available cash. On the other hand, paying down a low fixed mortgage rate may not make sense as current yields on cash are often higher that interest rates on mortgages put in place before this past year.

- High-yield savings and money market accounts. While most banks have not substantially increased rates on checking and savings accounts, many now offer higher-yielding savings accounts that pay better rates than traditional checking and savings accounts, although not as much as CDs and money market funds covered below. These accounts often have minimum initial deposit and minimum balance requirements, and may limit transactions. Money market accounts tend to come with checkbooks, while high yield savings accounts often don’t. Both are covered by FDIC insurance 3 subject to the FDIC limits of $250,000 per depositor per institution per ownership category.

- Money market funds (MMFs). Investment firms, including custodians such as Schwab, Fidelity and TD Ameritrade, offer funds that hold high quality, short-duration, commercial and government debt instruments. These are variable rate vehicles, so their yield changes in line with changes in interest rates. As of March 17, 2023, yields on such funds are as high as 4.48% for taxable funds, and generally about 2% for tax-exempt funds, with rates varying by investment size and other factors.

Investors can be confused as to the differences between money market accounts offered by banks and money market funds which are usually purchased through brokerage accounts. The former are liabilities of the bank and are covered by FDIC insurance. Money Market Funds, even if bought through a bank, are not covered by FDIC insurance. They seek to protect principal by investing in short-term, high-quality instruments. However, during 2008-2009, a few MMFs traded below the $1.00 per share initial purchase price. As securities, MMFs are protected by the SIPC4 which provides protection if the brokerage firm fails, but not loss due to a decline in market value.

- Certificates of Deposit (CDs). CD’s offer a fixed rate-of-return over a specified time period with lower liquidity than money market funds. Rates can vary quite a bit but are usually much higher than traditional checking and savings accounts. As of March 2023, the average 6-month CD is yielding 0.89%, but some banks are offering rates above 4%.5 CDs offered through banks are usually covered by FDIC insurance.

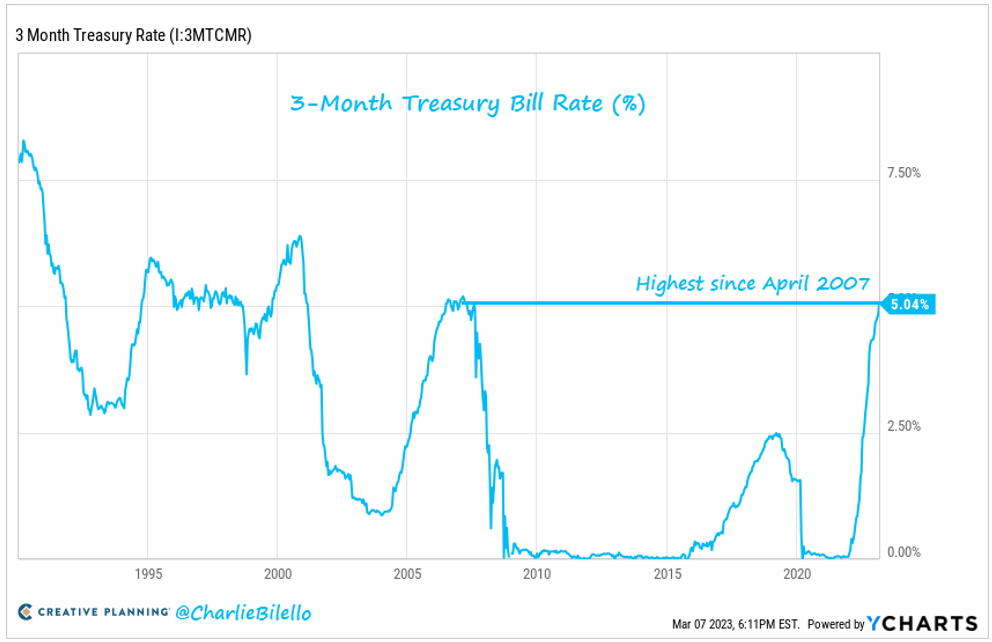

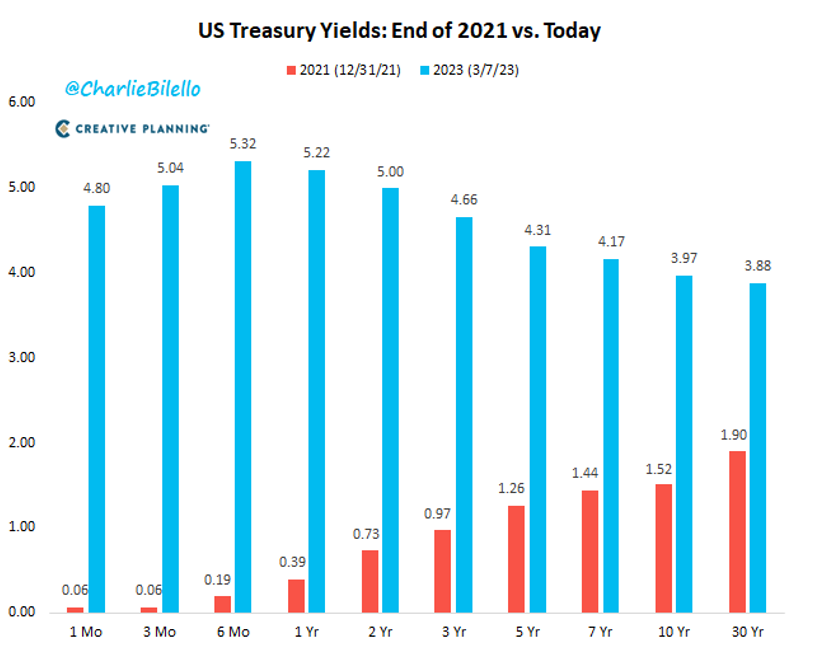

- Short-term Treasuries and bonds have seen their yields rise as the Federal Reserve has increased the fed funds rate. As of March 7th, the yield on 3-month Treasuries topped 5% as compared with 0.38% one year earlier. With the recent macroeconomic events in the banking industry, the 3-month Treasury yield is closer to 4.71% (as of 3/22) due to higher demand for short-term investments.

- Bond portfolios. For investors looking to lock in today’s higher rates, building a bullet or laddered bond portfolio may make sense. With the inverted yield curve, longer-term rates are not as high short-term rates, but offer a known yield over a multi-year timeframe. A laddered portfolio holds bonds of varying durations and reinvests maturing bonds. A “bullet” portfolio invests in bonds with a similar maturity date bought over differing times.

Building a Cash Allocation Strategy

While predicting the path of interest-rates is difficult, a cash management strategy should be mindful of the outlook for rates. If for the next 6-12 months rates increase slightly or remain around current levels, current yields on money market funds, CDs, and short-term higher grade bonds will prove attractive . That said, markets now expect the Fed to begin reducing rates either later this year or in the first half of 2024. Under such a scenario, at some point yields on cash equivalents could lag returns from longer duration assets such as equities, fixed income, and real estate.

Irrespective of the uncertain path for rates, it is important for investors to have a cash management strategy that fits their liquidity needs, time horizon, and risk tolerance. For investors in higher tax brackets, it is also important to consider after-tax yields as some short-term vehicles provide tax advantages.

Planning For the Year Ahead

We would encourage Ocean Heights clients to review the interest you are receiving on your current bank accounts, as well as the interest rates you pay on any balance sheet debt, e.g., mortgages and other loans. While it is still important to maintain a comfortable level of “emergency funds,” higher interest rates have improved opportunities for making your cash work for you. Ocean Heights has access to a variety of attractive and low-cost money market funds and CD’s through our custodians as well as bond strategies offered in conjunction with investment firm partners. This year, California residents who qualify for the Disaster Relief Tax IRS Extension will have tax payments delayed from April to October 16, offering an extra four months to put some cash to work.

Postscript: Recent Bank Turmoil

As we were writing the above, the news headlines have featured the turmoil in banking. While the details for each of the problem institutions are more complicated than we can address here, these events have heightened attention to the gap between rates paid to most bank depositors as we have described here, and to the importance of insurance protection for your assets. We have posted on our website more detailed review of the issues related to recent bank failures and what it means for bank and brokerage clients, realizing this is a fluid situation. For more information, please see “Our Perspective of Recent Bank Failures” which was published last week and available on our website.

If you have any questions as to your personal cash management strategy or on any of the issues discussed here, please reach out to any of our advisory team.

Sources:

1 fred.stlouisfed.org/series/FEDFUNDS

2 S&P Capital IQ Pro; www.fdic.gov/resources/bankers/national-rates

3 www.fdic.gov/resources/deposit-insurance/diguidebankers/general-principles/index.html

Disclosures:

Fixed income. Fixed-income securities carry interest rate risk. As interest rates rise, bond prices usually fall, and vice versa. Fixed-income securities also carry inflation, liquidity, call, credit, and default risks. Any fixed-income security sold or redeemed prior to maturity may be subject to a loss.

Bond ladder. Depending on the types and amount of securities within a bond ladder, it may not ensure adequate diversification of your investment portfolio. While diversification does not ensure a profit or guarantee against loss, a lack of diversification may result in heightened volatility of your portfolio value.

Money market fund. An investment in a money market fund is neither insured nor guaranteed by the FDIC or any other government agency. Although money market funds seek to preserve the value of investment principal, it is possible to lose money in these funds. Investors should consider the investment objective, risks, charges, and expenses carefully before investing. The prospectuses for these funds contain important information which should be carefully reviewed before investing.

This information is for educational purposes only and is not intended to be a substitute for specific individualized advice; please contact your advisor regarding your specific circumstances. Investing involves risk and the potential to lose principal.

Interest rate examples are for illustrative purposes only. Rates are subject to changes based on market conditions and are not guaranteed.

This piece is limited to the dissemination of general information pertaining to MPS’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but MPS does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.