Vladimir Putin’s invasion of Ukraine has unleashed a stream of events whose human toll will likely grow in the days and weeks ahead. That said, we as investors need to separate our emotional response to the human costs from our assessment of the impact to financial markets. To that end, we briefly outline here our thoughts on the events in Ukraine and the market reaction.

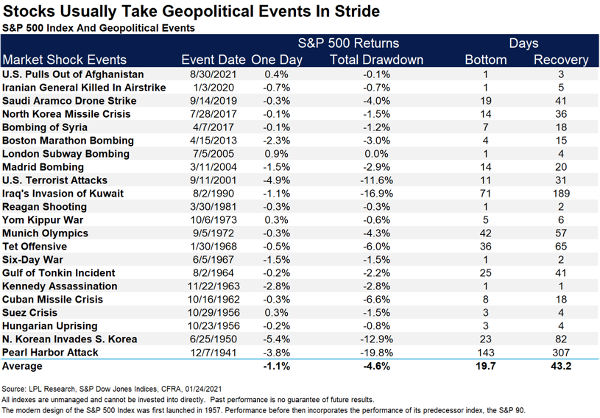

Historical Market Context. Looking at past geopolitical events in the chart below, we see that the historical pattern is for lower single-digit total drawdowns that bottom in an average of 20 days, with the time to full recovery averaging six weeks.

With military conflicts, markets tend to weaken leading up to the start of hostilities and then recover fairly quickly. This could well be the pattern with Ukraine as the prospect of invasion had been readily apparent for at least weeks if not months, leading to its economic impact being largely, if not entirely, priced in by the start of the actual invasion. Second, markets seem to have come to the view that the economic impact of Russia’s action will be less than what many feared. The principal fears and our view on how they will likely play out are as follows:

- Will Russia move on other countries? Russia invaded Ukraine to halt their increasing engagement with the West, especially on defense matters. Moves on other nearby countries are unlikely due to the mutual defense treaty of NATO members, Russia’s weak economy, Putin’s limited domestic political capital, and the costs Russia will bear from its engagement in Ukraine.

- Will the flow of Russian energy to Europe be cut off? Sanctions will target financial and technology sectors but stop short of energy actions that would risk recession in Europe. Russia’s energy flows west are not dependent near-term on Nordstream2, approval of which Germany has paused. However, the extent to which energy prices have already discounted constraints on energy supplies from Russia are unclear and will need to be monitored.

- How will the Ukraine situation impact inflation? The likely prospect is for a near-term inflationary impact due to energy and other commodities, but an intermediate term deflationary impact due to economic effects. Given the uncertainties, the European Central Bank’s proclivity for tightening monetary policy will only decrease.

- Will Russia’s conflict with the west expand cyberwarfare? Cyberwarfare is already here but it could worsen. Government and private sector investment in cybersecurity will remain strong.

Thursday’s equity market saw a monster intra-day reversal. After opening down several percentage points, major indices finished strongly up for the day, with the upward path continuing today as of this writing. Without hazarding a guess as to whether this was an important intermediate-term bottom, we think it could mark a peak in market concerns over Ukraine. But what that means is really that the market will resume its focus on inflation, tightening monetary policy, trends for corporate profits, and the pandemic.

On the foregoing scores, the recent data have shown improvement. Inflation numbers have started to decline, corporate profits remain strong, and the pandemic is waning with re-openings progressing. Part of the market’s strength over the last 24 hours is due to the view that the Russia-Ukraine conflict could restrain the Fed’s monetary tightening. Nevertheless, we expect the volatility we have seen this year to continue as it is a common accompaniment to rate-rising cycles as we are now entering. Equities tend to do well as rates begin to rise, but not without above-average volatility.

Weathering downturns. Market drawdowns are an inevitable part of investing. The average intra-year drop for the S&P 500 Index over the last 42 calendar years has been approximately 14% (Factset data for 1980-2021). Even with the recent market decline, the S&P 500 index is only back to where it was last summer.

However, drawdown periods are unsettling, tempting investors to sell or exit. Peter Lynch said, “The trick is not to learn to trust your gut feelings, but rather to discipline yourself to ignore them. Stand by your stocks as long as the fundamental story of the company hasn’t changed.” Long-term success in investing requires an acceptance of periodic setbacks.

Portfolio strategy. Key elements of portfolio strategy at this juncture should be a focus on both valuation and diversification. Over the last 2-3 years, the market concentrated its rewards on companies showing strong revenue growth almost irrespective of their other financial metrics. This year with the backdrop of rising rates, fundamentals like profitability and cash flow have come back into vogue, and the valuations afforded high growth firms have retreated. We expect this trend – which favors our investing style – will continue.

Lastly, we view diversification as particularly important in the current market in which sector rotations have been sharper than normal. For those with global portfolios, we will be paying close attention to how regional markets are impacted by the current geopolitical events. In recent months non-U.S. markets have outperformed the U.S. Moving forward however, cross-currents could shift regional relative performance.

In closing, may the thoughts and prayers of all of us be with the people of Ukraine.

The views expressed are for commentary purposes only and do not take into account any individual personal, financial, legal or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. The opinions are based on information and sources of information deemed to be reliable, but Mariner Platform Solutions, LLC does not warrant the accuracy of the information.