“By rationally looking at long-term trends instead of viscerally reacting to the horror story of the day, you’ll see that there’s much more to celebrate than to mourn.”

— The Wall Street Journal, excerpt from “For the New Year, Say No to Negativity,” Dec. 27, 2019

What a November…a rally for the record books. This has been one of the best recoveries ever recorded following a 10% correction in the market (the S&P 500 fell roughly 10% from its previous 2023 high in July through its October low before rebounding powerfully in November).1

Three Key Indices Rise

All three major U.S. large-cap stock indices—the Dow Jones Industrial Average (DJIA), the S&P 500 and the tech-laden Nasdaq Composite—rose more than 9% for the month.2 The DJIA’s total return, which has lagged these other two more growth-oriented and broader indices year to date in 2023, has eclipsed its January 2022 high and stands at a record high level in early December.3 The S&P 500 rose 9.1% in November (by far its best month in 2023) and is up more than 28% from its October 2022 low. It has risen almost 20% year to date in 2023.4 The Nasdaq advanced even higher at 10.8% for the month.5

Didn’t many experts suggest that technology-oriented stocks and growth stocks overall were supposed to be dead in 2023 in a rising interest rate environment? Interestingly, in the face of such dire prophecy for growth stocks, the technology sector in the S&P 500 is the leading sector of the market, surging more than 50% year to date.6 So much for that “expert” wisdom…glad we didn’t buy into that line of thinking.

The following catalysts might trump the potential negative impact of a reasonable rise in levels of interest rates for tech-oriented and growth stocks:

- demand for productivity-enhancing software in the midst of a tight labor market

- still-elevated inflation

- the huge appetite for processing capacity and speed at data centers

- significant cybersecurity challenges/needs

- historic breakthroughs in artificial intelligence technology

- build-out of 5G infrastructure and networks

- a significant transition underway toward adoption of greener technology and advanced driving systems, etc.

Market Turbulence Requires Patience

Regardless, there’s a key takeaway from this roller-coaster return behavior we’ve witnessed in the second half of this year and during the past two years. That is, patience is a virtue when navigating turbulent times in the market. Case in point: Despite the head-spinning news flow we’ve had to absorb these past several years regarding inflation, Federal Reserve policy, geopolitics, risk of recession, etc., and the associated price swings this climate produced, the market has advanced handsomely in 2023, is basically flat over the last two years and is up roughly 12% annually over the past five years.7 Not bad! Certainly better, I’d bet, than it may feel given the significant volatility in the market these past couple of years.

Maintaining patience and perspective is important when examining the contrast in price behavior between the swift and sizable 10% correction in the S&P 500 this past summer and the swoon to follow. It was also helpful during an equally potent recovery in late October and November and during the similar juxtaposition in market dynamics during the 22% swoon in stock prices in 2022 versus the surging recovery in the S&P 500 and approximate 20% return this year.

What caused these rapid shifts in price trend and psychology? Zeroing in on just 2023, let’s revisit the narrative and investor mindset back in late July right after the S&P 500 hit a new 2023 high of 4,588. We’ve had violent swings in performance since then…from 4,588 down to the 4,100 level and now back to roughly where we started in July at 4,594 as of this writing. Whew!

Basically, we’ve just completed a round trip. As we moved through the spring and into mid-summer, folks were becoming much more optimistic about likely market direction based on calming inflation data that implied the Fed might be able to pause interest rate hikes and solid/better-than-feared economic and earnings data that seemed to portend declining risk of recession.

Hence, we rallied and hit the July month-end 2023 highs. My, how moods changed in short order. Quickly, the bears seemed to take control again in August and seize the reins in the ongoing bull/bear tug of war underway this year.

News Headlines Fueled Negative Sentiment

A couple of major bearish arguments surfaced in the press and seemed to take root at that point. First, the naysayers noted that we were entering a very weak period in the market from a seasonal standpoint. Specifically, September and October tend to be poor months for the S&P 500, and they are months that are salt and peppered with some of the worst market declines on record. This negative slant was amplified by continued rhetoric from Fed Chair Jerome Powell and company that the Fed’s battle against inflation was not over and we could “see higher short-term rates for a longer period” than investors expected. Other wall of worry items became front and center as well during this time and included breakout of conflict in the Middle East, chaos in the U.S. House of Representatives with a temporary inability to name a speaker and fund the government along with rising concerns about our fiscal debt. These all seemed to contribute to a major surge in 10-year Treasury yields to the 5% level.8

Fundamentals Held Steady

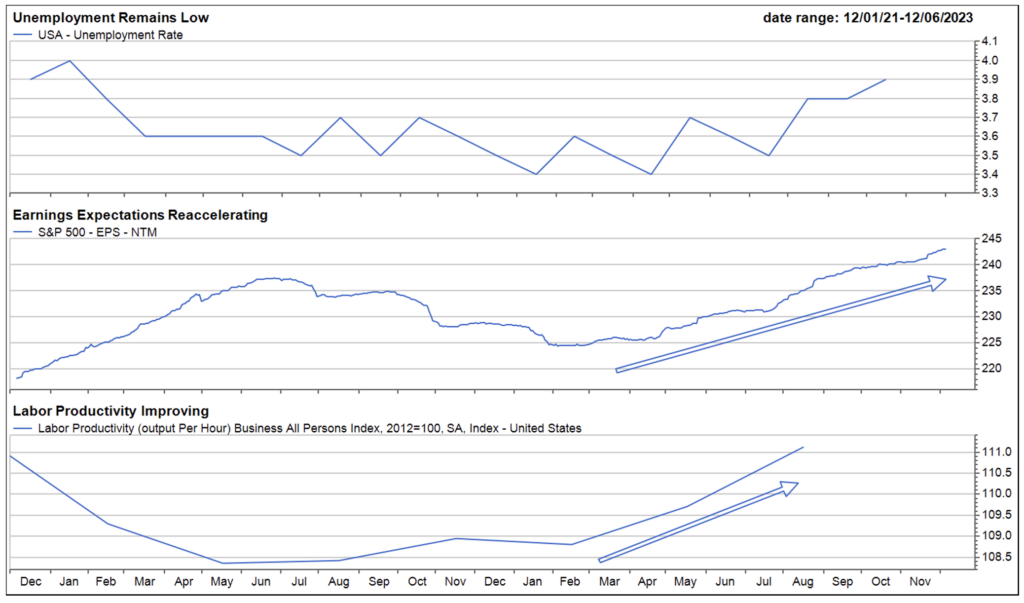

Our take was that most of these wall of worry items would be managed in better-than-feared fashion and conclude with less-than-worst-case outcomes. More important to us, in maintaining our constructive view on the market throughout this period of sharp shifts in stock price trends and investor mood, was that the underlying fundamental data didn’t really change. It remained supportive, and, if anything, it improved in key areas. The economy was continuing to demonstrate impressive resilience via an employed and engaged consumer. Surprising strength, or a renaissance of sorts, was developing within the capital spending arena. S&P 500 earnings were improving and reaccelerating as we moved through the second and third quarters, not weakening as the bears incessantly warned. Productivity improved dramatically.

Source: FactSet

This was not a backdrop that signaled the need to act and reduce stock allocations below normal, long- term targeted levels, in our view. It was an environment supportive of our calendar 2023 year-end target for the S&P 500 of 4,500 and of 4,800 to 5,000 by mid-2024.

The one risk factor that did catch our attention in a big way was the rise in Treasury yields. We were comforted by the fact that inflation continued to ease. We know it is generally the trend in inflation that ultimately drives trend in bond yields; therefore, we thought yields would settle. We are pleased that the 10-year yield has indeed eased as we thought it would, and, notably, it has declined back to the 4.3% level from the 5.0% peak.9 We will continue to monitor the trend in yields and would likely become more cautious should they reverse course and look to rise significantly above 5% in the future. We think this is unlikely, but stay tuned.

Stay Focused on the Facts

Bottom line, we take our cues now, and all times, from the hard data…trends in inflation, revenues, earnings and interest rates, not from headlines. These key metrics are supportive of positive returns at present and are trending in the right direction, much as they were in previous periods similarly characterized by whipsaws in market returns like the ones we have experienced these past 24 months.

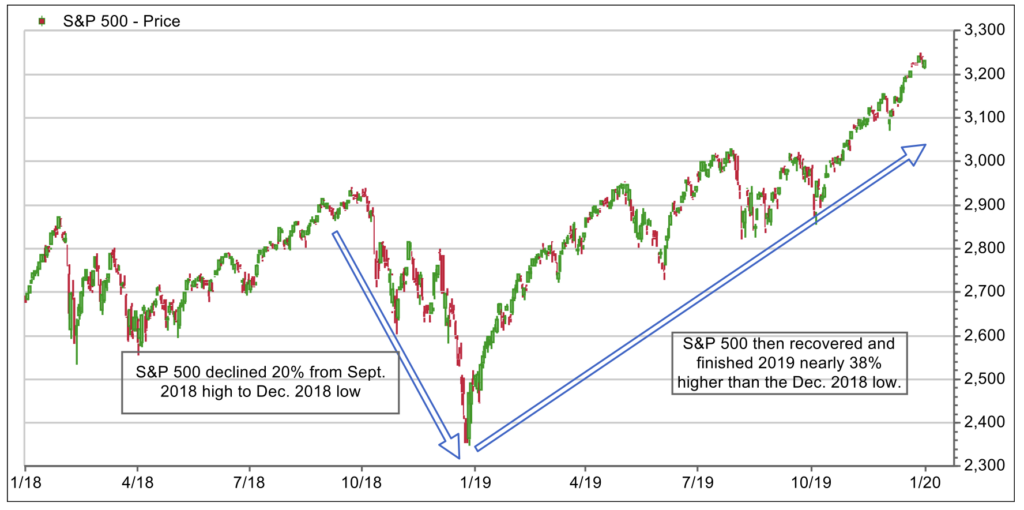

History can often provide us with perspective and teach us valuable lessons about today. The snapback reversals following sell-offs in December 2018 and March 2020 are great examples and similar case studies. In December 2018, fundamentals, such as earnings and real gross domestic product growth, were just fine, yet investors chose to obsess back then about their fear that the Fed might hike too quickly in the middle of tense trade talks with China and cause a recession…that never happened. The data was fine, yet the market fell 20% from the September 2018 peak to December 2018 trough over these fears. When data released after the new year in 2019 confirmed solid demand and earnings conditions and affirmed that we weren’t anywhere close to recession, the market took off and advanced over 37% in 2019 off the December 2018 low. Investors would be filled with regret if they sold stocks in December 2018 when much of the world was bearish.

Source: FactSet

Similarly, in February of 2020, the S&P 500 fell 35% in four weeks only to recover and hit new highs quickly thereafter and to advance 70% off the March bottom by year-end. At the time the market was dropping, this was a scary moment. But we focused on the facts and maintained our “hold your ground” view. The spring/summer slowdown that year was a forced economic shutdown. A very loud bearish camp missed the fact that the underlying economy was quite strong and would be supported by fiscal stimulus to bridge the gap until the U.S. economy could reopen and the social distancing would end. Premature action and selling in March to take stock allocation below normal levels would have been catastrophic.

Source: FactSet

Does any of this sound familiar to the events of 2022/2023? The market sold off 22% in 2022 because folks feared a recession might occur in 2023. That has not come to pass. There’s a reason Paul Samuelson has been quoted as saying, “The stock market has predicted 9 of the last 5 recessions.”

Yes, we were surprised that the 2022 pullback persisted as long as it did, but we advised folks going into 2022 to trim back to normal stock allocation levels if the prior three years of 26% annualized compounded returns had taken them to well above normal. We simply believed it was rare to see four consecutive years of double-digit returns (this has only happened twice in history) and that price-to-earnings ratios (P/E’s) were likely to contract in a year of transitions in Fed policy and inflation. Transitions not to something horrible but just to something different, which makes folks nervous and more risk averse for a bit until we get through the peak of the transitions.

We advised clients to hover at their normal long-term stock allocation and maintained a hold your ground view throughout 2023. Contrary to the consensus view, we were quite positive going into this year that has delivered healthy returns. Further, we suggested in mid-2023 if you had not trimmed back to normal earlier in 2022 and the rally in the first half of this year took your allocation back up to above normal that July 2023 might be the chance to trim back to normal. If you were already at normal, we advised you to stay put. I’m sure that investors who maintained their normal stock exposure are thrilled with the strong results on a year-to-date basis in 2023.

Interestingly, the market sold off temporarily in late summer 2023, once again because of fear more than facts…fear of rates rising significantly above the 5% level and a resulting hard-landing recession that has not come to pass. This fall, the S&P 500 has recouped its summer losses.

I enjoy reading well-known economist Ed Yardeni. In a recent morning note, Ed championed a theme inspired by a famous quote President Franklin Roosevelt delivered in his address to our nation following the 1941 Pearl Harbor attack that brought the U.S. into World War II: “We have nothing to fear but fear itself.” We should remember that as we enter 2024.

We’ve been afraid of recessions and our own shadows in 2022 and 2023 and of things that simply didn’t come to pass, or at least haven’t yet. The facts and data are solid—neutral at worst. Hence, so is our view. As John Maynard Keynes said, “When the facts change, I change my view,” as do we, but not until then. Perhaps as we enter 2024, with inflation and rates easing and earnings moving in a better direction, we can look forward to more stable, sober results and mood. Or at least worry when warranted by the data and for the right reasons.

Avoid Whiplash

One of the most important things we can do in serving our clients is to help them avoid suffering whiplash and taking unneeded action when market participants are unduly negative and emotional while the market fundamentals and valuation levels are still reasonable to positive…as they have been throughout this 2022/2023 period.

Excessive trading to try and time the market when the data is still constructive, yet stock prices are exhibiting whipsaw-like behavior (like they have been these past several years) generally is a bad idea. A more patient approach centered on fact-based decision-making can help minimize the risk borne by market-timing individuals who too often sell too late in the corrective period after they simply become impatient in the negative price trend and fear what it may mean…and then fail to get back in quickly enough when affirming data refutes the bear case and restores confidence in more cautious-natured investors. They tend to experience much of the downside when prices are falling and before they get out and tend to miss much of the ensuing rallies off the lows such as in 2019, the second half of 2020 and the strong 2023 on the heels of a disappointing 2022.

Now, there are moments in history, such as the 1930s, 1970s, 2000 and 2007 to 2008, when the data is truly negative and supportive of taking defensive action. However, most of the time, the data is neutral (like it is today) and supportive of normal trading activity and positioning. Decades separate these extreme periods…they are very rare. Historically, the U.S. economy is in recession less than 20% of the time going back to the late 1920s and including the Great Depression. Earnings growth is positive far more often than negative, and the U.S. stock market advances more often than it declines.10

Where Do We Go From Here?

We’ll keep you guessing for a bit on the details and specifics so as not to steal the thunder from our upcoming Crystal Ball Outlook webinar that we’ll deliver in January 2024. Suffice to say now that we have remained constructive about 2023 and 2024. We established our 4,500 S&P 500 price target for 2023 roughly one year ago, and we have maintained it throughout the bumps and air pockets this year. Given that the S&P 500 stands at almost 4,600 as of this writing, we’ll gladly apologize for being just a tad conservative about 2023 results if we end up finishing there or above. In mid-2023, we established targets of 4,800 to 5,000 for the S&P 500 by mid-2024, still believe that trend is correct and look for solid returns for the full calendar year.

In the Crystal Ball webinar, we will update targets for the 2024 full calendar year. Clearly, we do not think this recovery in stock prices in 2023 has been a “castle in the sky” as suggested by skeptics. We believe it is based on a solid, resilient economy, improving earnings, surprisingly positive trends in capital investment and calming trends in inflation and interest rates. The greatest risk to watch in our mind is the trend in bond yields. We expect them to continue to stabilize and settle at these levels or lower. However, if they should reverse course and move meaningfully higher, this would concern us. We don’t expect that.

Positive wildcards in 2024 that have a high probability of upside surprise include a resurgence in labor productivity that can enhance margins and profits and thawing relations with China. We don’t think politics will derail any of these good vibes.

On the recession front, even if we have one in 2024, it should be of the mild variety, as credit conditions remain healthy, and unemployment remains at lower levels than seen during true, hard-landing scenarios. In the midst of a normal recession, the market advances 50% of the time, and we think this could be the case should this occur next year.

A Little Perspective

For some context, this has not been a bubble-like market in 2023 as the bear camp suggests. In fact, we could argue we’ve experienced a stealth bear market this year and over the last two years. Only three sectors in the S&P 500 are meaningfully positive this year—the rest are weak or in negative territory. The equal-weighted S&P 500 in which all stocks contribute equally to return regardless of size has returned 6.6% year to date through the end of November relative to the 20.8% for the cap-weighted index that does take company size into consideration. It has been a very narrow, concentrated market. It is hardly the time to run from stocks. After challenging behavior like this, it is the time to be assembling your buy list as we do consistently in the internal equity strategies we manage. One of the things we appreciate about the recent rally this fall is the improving technical price trends and broadening out in market leadership, which is a stock picker’s delight.

Wrap-Up

I selected this month’s quote for a reason. I pulled it from a 2019 Wall Street Journal article, “For the New Year, Say No to Negativity.” Read it if you can. It is a fascinating take about human beings’ innate negativity bias. Clinical studies demonstrate that we all react much more to negative news than we do to positive data and praise. The press knows this and preys on this bias when they write about the financial markets. For health, happiness and wealth accumulation, let’s go on a “low bad news” diet in 2024 as the article suggests and stay focused on the facts.

Sources:

1-10FactSet

The Dow Jones Industrial Average (DJIA) is an index that tracks 30 large, publicly owned companies trading on the New York Stock Exchange (NYSE) and the NASDAQ.

The S&P 500 Index is a market-value weighted index provided by Standard & Poor’s and is comprised of 500 companies chosen for market size and industry group representation.

The Nasdaq Composite Index is the market capitalization-weighted index of over 3,300 common equities listed on the Nasdaq stock exchange.

The indexes mentioned herein are unmanaged and cannot be directly invested into. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This commentary is for informational and educational purposes only and is limited to the dissemination of general information pertaining to economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but we do not warrant the accuracy of the information that any opinion or forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Actual results or developments may differ materially from those projected. Consult your financial professional before making any investment decision.

Mariner Advisor Network is a brand utilized by Mariner Independent Advisor Network (“MIAN”) and Mariner Platform Solutions (“MPS”). Investment advisory services are offered through Investment Adviser Representatives registered with MIAN or MPS, each an SEC registered investment adviser. Registration as an investment adviser does not imply a certain level of skill or training. MIAN and MPS comply with the current notice filing requirements imposed upon registered investment advisers by those states where they transact business and maintain clients. MIAN and MPS have either filed notice or qualify for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MIAN or MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

For information about which firm your advisor is registered with, please refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov) or the Form ADV 2B provided by your advisor.

Investment Adviser Representatives are independent contractors of MPS or MIAN and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS or MIAN and is not registered with the SEC. Please refer to the disclosure statement of MPS or MIAN for additional information.