Dear Clients and Friends,

In light of the recent economic headlines and market movements, please see the below thoughts from our Investment team. We are actively monitoring current developments and client portfolios and are available to speak should you have any questions.

The Fed prioritizes the inflation fight.

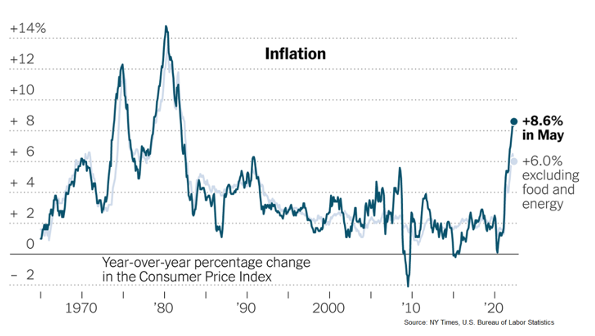

A difficult market year has turned even more volatile of late as the May inflation number released on June 10 came in at a higher-than-expected 8.6% year-over-year print. This dashed hopes that inflation might have peaked and that pressure on the Fed to amp up its monetary policy tightening might begin to wane. The S&P 500 dropped more than 10% in a week, broaching the 20% decline commonly used to define a bear market.

As inflation accelerated throughout 2021, the Fed hung on to its easy money policy, asserting that a significant portion of inflation would prove “transitory.” Whatever merit there was to this view has been overwhelmed by events this year. The war in Ukraine has spiked energy and food prices, and China’s COVID lockdowns have exacerbated supply-chain disruptions. Inflation has jumped not just in the U.S., but globally. With the May inflation print, the Fed’s dovish elements capitulated to the data reality. What had been expected as recently as a week ago to be a 50-basis point rate hike became a 75-basis point hike announced Wednesday. This was the largest rate hike since 1994. Changes in monetary policy usually take 6-9 months to work there way into the overall economy, so we may not know for a while how successful the rate hikes have been in achieving their objectives of cooling off the economy and reducing inflation.

Equities rallied strongly on the day of the Fed announcement. The positive response was viewed by some as the Fed restoring some measure of credibility as to its inflation-fighting bona fides. Others noted Chair Powell’s supportive comments as to the prospects of a “softish” landing, i.e., tamping inflation down to target levels without causing a recession. However, the market fell back the following day (Thursday) as investors focused more on the risks to growth from the Fed’s inflation-fighting resolve.

Recession fears may be outrunning the reality.

Most of the decline in equity markets this year can be ascribed to a re-rating of price-earnings (PE) multiples in response to higher interest rates. Over the first five months of this year, the S&P 500 forward PE multiple fell from 22 to 17, while the U.S. Treasury 30-year yield moved from 1.88% to 3.03%. The latter almost entirely explains the former.

However, recent market weakness has also been driven by fears for economic growth and its carryover effect on corporate profits. Equity multiples reflect not only interest rates, but also expectations as to future earnings. Q1 earnings met expectations, and earnings estimates for the rest of the year haven’t really declined. However, current earnings estimates are at odds with widespread expectations for a coming recession.

Many media talking heads regard recession as almost a given. Even Cardi B is tweeting about a coming recession. Nevertheless, careful observers such as Goldman Sachs’ highly respected economics team put the probability of recession before the end of 2023 at under 50%.[1] Goldman notes consumer strength as evidenced by spending trends, balance sheets, and debt service levels, a view reinforced in several recent CEO interviews, e.g., Bank America’s Brian Moynihan. With consumer sentiment plumbing multi-year lows, it is important to distinguish between attitudinal measures and actual behavior. Consumers may hate high gasoline prices, but the current reality is that with flush bank accounts and balance sheets, spending levels remain strong and most companies have thus far been able to pass along their higher input costs.

What if we do get a recession?

At this point, no one knows if we will see recession, but the risk is real. The majority of past rate hiking cycles have triggered recession. If inflation is “too much money chasing too few goods,” the Fed’s task this time is made tougher because a large part of the current problem is constrained supply. Higher interest rates can dampen demand, but they won’t create more oil or wheat.

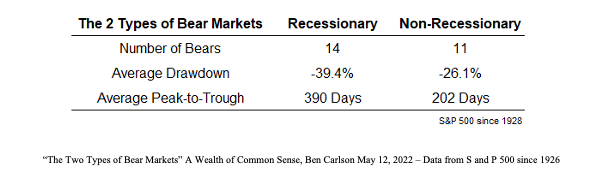

Using the customary 20% definition, we are now in a bear market. However, different areas of the market have experienced different levels of drops, with many speculative stocks dropping much more than high quality companies. That said, it matters a lot whether we are heading for recession. Bear markets outside of recessions tend to be shorter and less severe than those associated with recessions lasting an average of 202 days vs 390 days and with an average drawdown of 26.1% vs 39.4%. 2

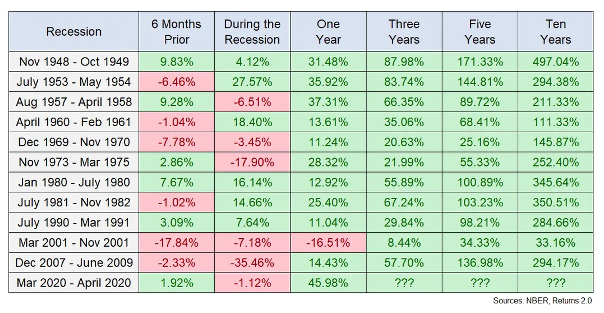

Markets and the economy are often not in sync with one another. The above data is based on market peak-to-trough returns which maximizes the drawdown (the S&P peaked on January 3, 2022 or 165 days ago). It is worth remembering that market returns are typically weak prior to and during a recession but very strong in the following 1,3, 5 and 10 year periods. The chart below shows returns relative to the start of recession, a date which is only known some months after the onset of recession.

The combined message of these data is that, even if we are entering a recession, we have likely already seen the bulk of the share price damage.

Catalysts For Sustained Market Improvement.

Recent market advances have been bear market rallies into which we have avoided upping equity exposure beyond clients’ baseline allocations. Signs we are watching that would make us more optimistic as to equity exposure include:

- Less bad inflation data. Equities should rally when inflation increases have peaked and suggest that Fed monetary policy may become less tight than whatever is then priced in. The baseline effect will be helpful here as inflation readings are typically based on the previous 12-month period.

- OK economic and earnings data. The economy and earnings do not have to get better from this point for the market to improve. They just need to not get materially worse as inflation comes down.

- Investor capitulation. We watch a list of indicators that signal investor capitulation near market bottoms. Some indicators have been tripped – most have not as of yet.

- Dollar weakness. Recent dollar strength has been a headwind for equities. While dollar strength can be either bullish or bearish, in the current context, we believe that equities would be favored by a weakening dollar.

- Lessening of Ukraine conflict. When this happens as it eventually will, markets will respond very favorably. We are not holding our breath as to when this might occur.

Portfolio Positioning.

Multiple famously successful market investors have advised that the best way to navigate bear markets is to make very few portfolio moves. This approach was made easier for us this year by coming into the year with a lot of highly appreciated holdings for whom selling in taxable accounts would be painful. Leaving the tax angle aside, volatile markets are challenged by sharp swings in market leadership and sector rotation that are a set-up for getting whipsawed. We have tried to trade around these swings to only a minimal extent.

We are pleased with how our portfolios have navigated the year to date and ascribe this to our investment process which favors quality companies, reasonable valuations, and growing dividends. This process has avoided the speculative areas of the market where we have seen catastrophic returns. We wish we could tell you that we saw Ukraine or the huge outperformance of the energy sector coming, but we did not. However, a sound investment process that is designed to whether well market and economic downturns has been a good substitute for the crystal ball we didn’t have.

We expect to see good market entry points in the coming months. We will watch our signals for guidance, but with no expectation as to catching the market bottom. We will remain focused on holding stocks of good companies likely to perform well through full market cycles.

Sources:

1 “Goldman, JPMorgan Strategists See Recession Fears as Overblown,” Bloomberg.com, May 19,2022

2 “The Two Types of Bear Markets” A Wealth of Common Sense, Ben Carlson May 12, 2022 – Data from S and P 500 since 1926