September has historically been the equity market’s weakest month of the year, and the current month is following this pattern with the S&P 500 down 6% for the month as of Friday, September 23rd. The market is now only 1% above the June lows, and 12% off the peak of this summer’s rally.

The principal cause for the current weakness is clear. Inflation is declining at a slower pace than either the Fed or markets expected. Hence, the Fed has felt compelled to ramp their hawkishness. The July rally was triggered by a combination of modestly favorable inflation data and evidence of a slowing economy, giving life to a narrative that the Fed might “pivot” to lower rates as soon as the first half of 2023. In August, disappointing inflation data led the Fed to effectively quash this narrative, communicating their belief that higher rates would be appropriate for longer than markets were expecting. This view was hammered home last week with the Fed statement and Powell’s comments.

With a Fed pivot likely off the table for at least the next six months, what is the outlook for equity markets? Given the uncertainty around inflation and how the economy will respond to higher rates, the most confident forecast we can offer is elevated volatility as investors react to incoming data. Due to the effect on Fed policy, bad economic news in the period ahead will tend to be good for equities and vice versa, adding to the volatility risk.

Next to inflation data, markets will be most sensitive to corporate earnings. To date this year, earnings have been resilient with consumers continuing to spend and companies generally able to pass along their higher costs. During earnings season (which begins next week) stocks tend to rise as most companies manage earnings expectations to a level that they can exceed, and companies are freed to do share buybacks after their earnings report.

Next to inflation data, markets will be most sensitive to corporate earnings. To date this year, earnings have been resilient with consumers continuing to spend and companies generally able to pass along their higher costs. During earnings season (which begins next week) stocks tend to rise as most companies manage earnings expectations to a level that they can exceed, and companies are freed to do share buybacks after their earnings report.

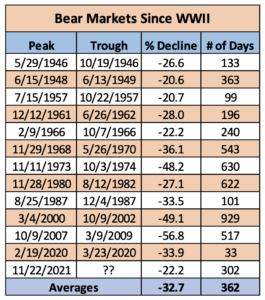

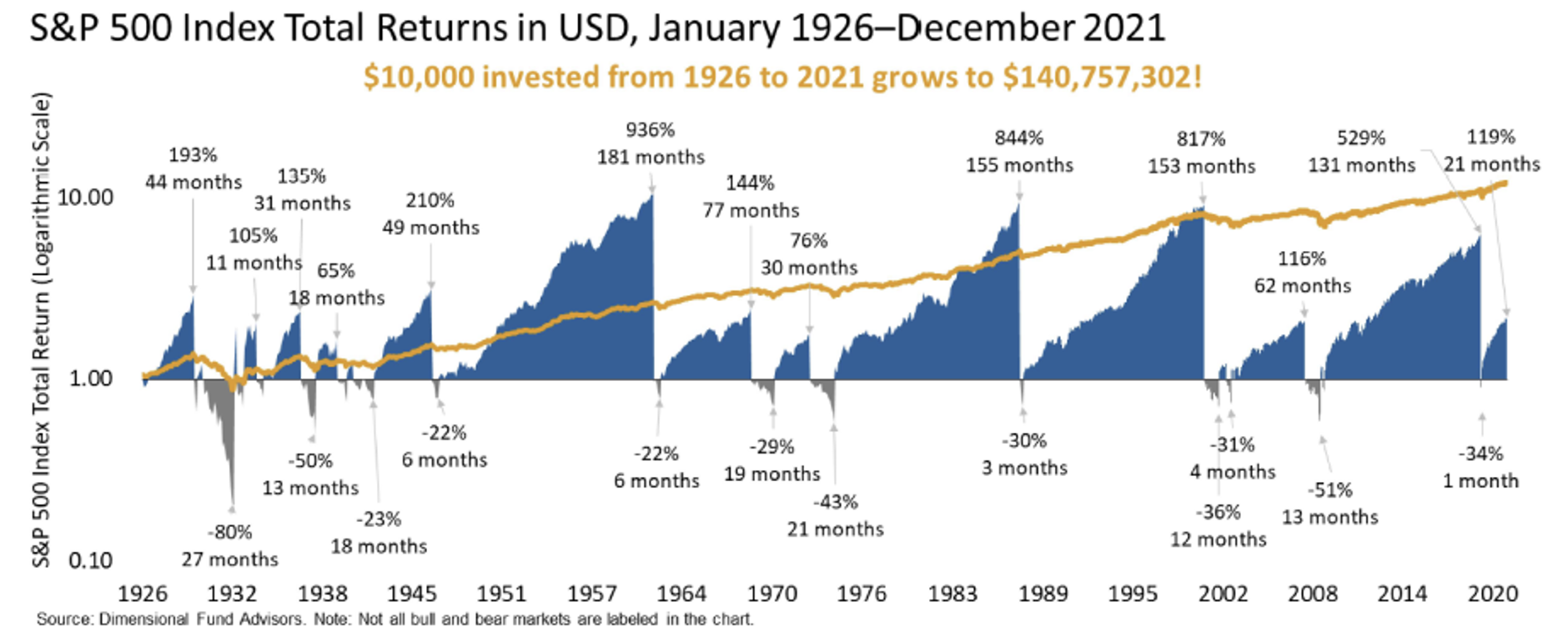

While the odds of recession have risen with the Fed’s hawkish policy tilt, the tight labor market and strong consumer balance sheets argue for any recession being mild. Bear markets accompanying mild recessions have also tended to be less severe than average bears. As shown in the chart in the accompanying document, the current bear market has thus far been one of the mildest of the 13 bear markets since WWII1. Bear markets have historically occurred in about one of every six years. However, periodic bear markets have not prevented the S&P 500 from averaging an 11.8% annualized return since its inception in 1928 (see S&P 500 history chart in attached document).

Second, it is important that each investor has an asset allocation appropriate to their risk tolerance and investment time horizon. This has been harder to accomplish this year than usual in that fixed income has experienced its greatest loss in history. With rates having risen, higher yields and lower interest rate risk have better positioned fixed income to serve its traditional role in balancing portfolio risks.

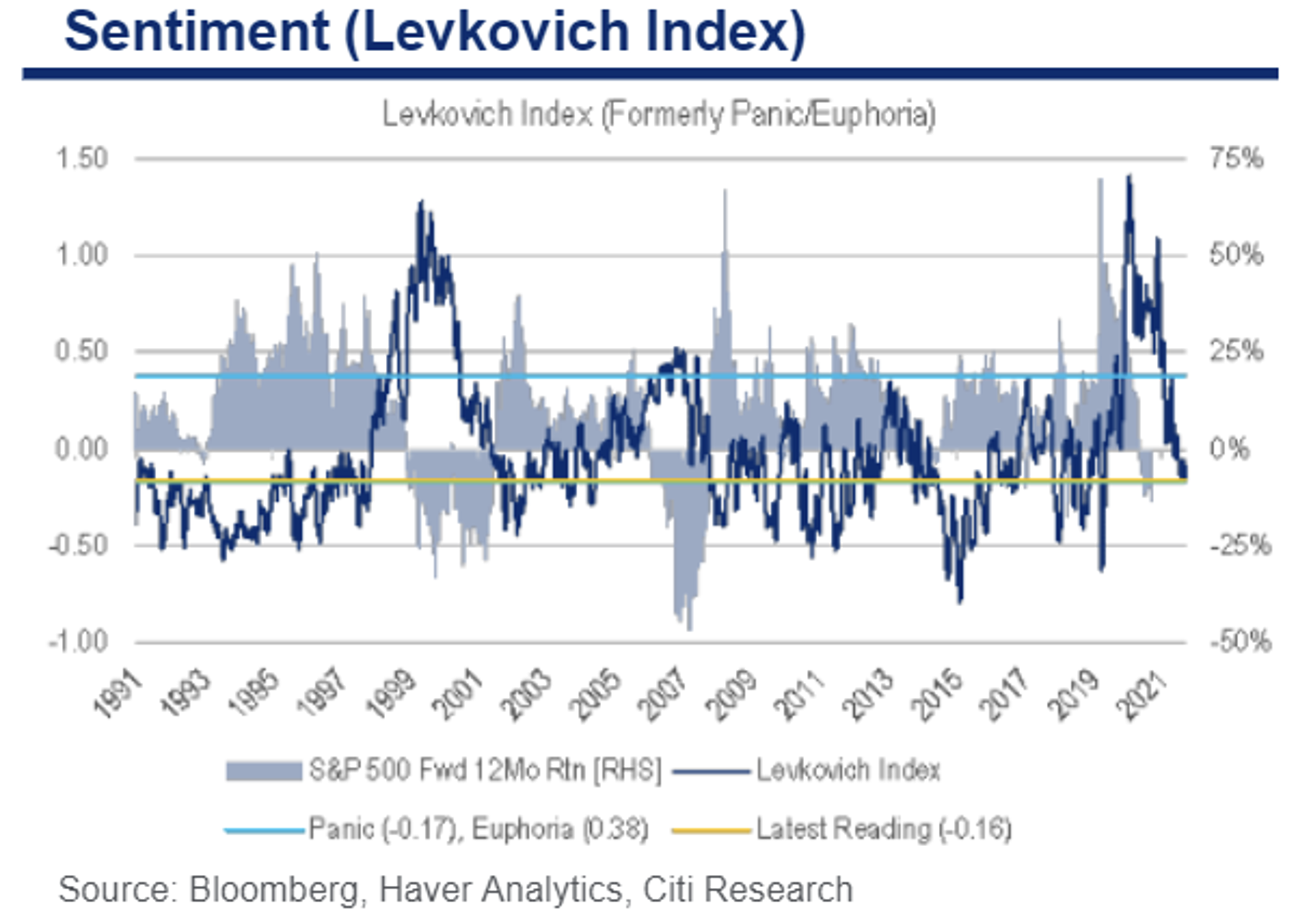

While recent market news flow has been negative, there are some bright spots on the horizon. Mid-term election years have tended to see three quarters of a flat to down market followed by strong performance in the fourth quarter. Additionally, investor sentiment has become exceptionally negative which augurs bullish in that forward market returns are inversely correlated with investor sentiment. Markets are moved by developments that differ from investor expectations. When expectations are extremely negative, even news that is “less bad” than expected move a market higher. To illustrate, the chart in the attached document shows the “Lefkovich Index” (formerly called the “Panic/Euphoria index).2 Historically, forward returns from the current near-panic index reading have been positive 95% of the time.

While portfolio declines are an unavoidable and unpleasant aspect of equity investing, we are pleased with how our portfolios have been weathering this downturn. We do not anticipate any significant shift in portfolio strategy. Trades that clients will see in their accounts during this period will mostly be rebalancing for tax-loss harvesting, and some reduction in our non-U.S. exposure which we are decreasing below what was already a low level.

As usual, please call or email with any questions on market conditions or your portfolio.

Best wishes,

Kevin Barlow and Kevin O’Grady

Sources:

1 AWealthofCommonSense.com, September 22, 2022

2 Bloomberg.com, John Authers, September 11, 2022

This piece is limited to the dissemination of general information pertaining to MPS’ investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on the information and sources of information deemed to be reliable, but MPS does not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

The indexes referenced herein are unmanaged and cannot be directly invested into. Asset allocation does not guarantee a profit or protect against loss in declining markets. Investing involves risk and the potential to lose principal. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.