Dear Clients and Friends:

With both equity and bond markets coming off a rough several weeks, we’d like to share some thoughts on current market conditions.

The proximate reasons for the recent market weakness are clear. Inflation is hitting multi-year highs. In response, the Federal Reserve has begun a tightening cycle, and comments from Fed spokespersons and market expectations are trending distinctly more hawkish. The war in Ukraine, which has boosted inflation in energy, foodstuffs, and metals, shows no signs of ending soon. China’s persisting COVID lockdowns have continued to impact supply-chains.

The combo of weak markets and dreary headlines has many investors asking “will we have a recession and/or bear market?” The prospects for recessions and bear markets are linked in that it is uncommon to have one without the other. Since the antecedents of recession are somewhat easier to assess, let’s look at some of those.

U.S. economy is growing above trend but decelerating. According to a report recently issued by the Conference Board1, U.S. GDP is projected to grow 3% this year, with this forecast incorporating a 0.5% estimated hit from the Ukraine war’s effects. While 3% is well below the 5.6% U.S. growth in 2021 and expectations for 2022 at the beginning of this year, it is above the 2% multi-year trend for the U.S.

Markets respond to economic data primarily in terms of its indicated directional change. “Good or bad” isn’t as important as “better or worse.” In this regard, recent economic data have been mixed, but on balance their message is that the economy’s rate of growth is decelerating. Investors might be fine with a deceleration to 3% growth were it not for the Fed’s ramping battle against inflation.

Is inflation peaking? The CPI surged to 8.5 in March, the highest reading since 1981. Business and consumer confidence declined sharply, especially as to future expectations.

Evercore ISI Research recently wrote “inflation is probably peaking now,” noting that gasoline futures have rolled over, trucking and shipping rates are declining, and commodities are off their highs.2 We would add that used vehicle prices and manufacturers’ backlogs declined in April, along with various measures of the red-hot housing market.

Offsetting slowing inflation for goods is inflation in the services sector which comprises about two-thirds of U.S. GDP. Services sector inflation is “stickier” and more closely linked to employment costs. So while U.S. inflation may be peaking, core inflation is unlikely to drop below 4% for the rest of this year.

Will Fed tightening trigger recession? Throughout 2021, the Fed held off policy tightening in the face of rising inflation, asserting that much of the inflation was due to “transitory” factors. With lingering COVID outbreaks, the war in Ukraine, and flush consumers, inflation has continued to rise. Inflation is now at a 40-year high, and the Fed is pressured from multiple sources to accelerate its inflation response. But can the Fed slow the U.S. economy enough to bring down inflation without causing a recession?

Of the 13 Fed interest rate hiking cycles since WWII, three of them were not followed by a recession. For six others, a recession only began more than two years later, raising questions as to any causal relationship.3 Goldman Sachs economists estimate the probability of a recession within the next 12 months at 15% and within the next 24 months at 35%.4 They note that the exceptionally tight labor market gives the Fed room to tighten to a point where companies put some expansion plans on hold and close some job openings without their having to slash output and lay off workers. Goldman also points to the record-high ratio of household-net-worth to disposable income and elevated personal savings as reasons why a slowdown in income growth is less likely to cause households to sharply curtail spending as in past cycles.

Peak hawkishness? Just as markets respond to “better or worse” with respect to economic data, the same is true for Fed policy. The spate of recent Fed hawkish statements signaled that rate hikes will be more than previously expected. Markets are now adjusting to an expected Fed funds rate of roughly 3.0% by year end. However, once the Fed begins to see their desired impact on inflation, their need to signal more than expected tightening will recede, with a likely favorable market response.

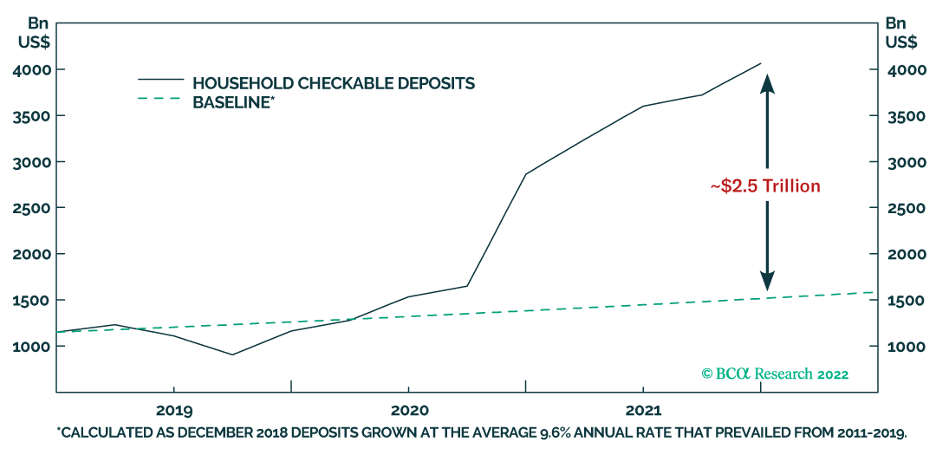

Excess Cash and Strong Balance Sheets. Today’s inflationary environment differs from those in the past as both supply and demand factors are prominent contributors to higher prices. U.S. household cash and money market balances are $2.5 trillion higher than they were pre-pandemic. This has allowed consumers to absorb higher prices and companies to maintain profit margins.5

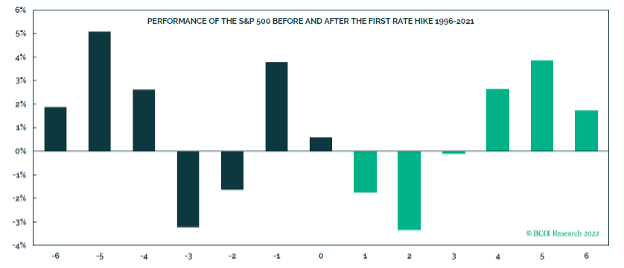

Historical patterns suggest a choppy market into a strong year end. While history indicates that market tend to be higher both six and 12 months following the start of rising rate cycles,6 periods just before and just following the start of rate rises (which is where we are now) tend to be volatile with a negative bias (see chart). These data, coupled with the pattern for mid-term election years which shows a tendency for strong fourth quarters following weaker earlier quarters7, suggest reasons to expect a stronger finish to this year.

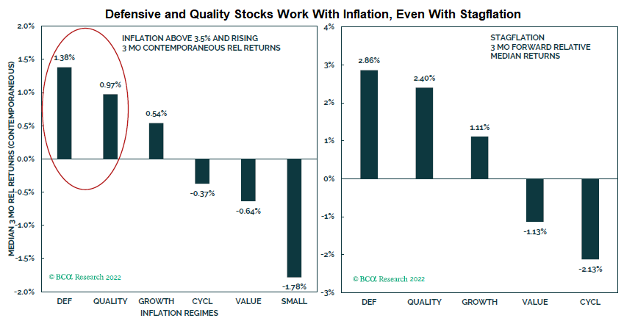

Portfolio strategy. Recent months have seen some sharp rotations among market sectors. While a diversified portfolio is always a good idea, it is especially so in the current market. Our investment process favors stocks with metrics that are long on quality factors because our quantitative research has shown that these factors contribute to the solid, long-term, risk-adjusted returns we seek. In some recent years, the momentum and growth investing styles were in favor, and our quality tilt was not. However, as shown in the accompanying chart, quality stocks tend to do well in inflationary periods. Knowing that our investment process is aligned with the market backdrop makes it easier to weather the current volatility. You may see a pick up in trading activity in your accounts as we look to rebalance portfolios given market movements and align both our equity and fixed income portfolios with the current market environment.

If you have questions or concerns about market conditions or your portfolio, please do not hesitate to reach out to us.

Warm wishes,

Kevin Barlow & Kevin O’Grady

Sources:

1The Conference Board: “Economic Forecast for the U.S. Economy, April 14, 2022

2Barron’s: “Inflation is Peaking, that Doesn’t Mean Prices Are Going to Fall.” April 5, 2022

3Charles Schwab Market Commentary: “Tight Rope: History’s Lessons About Rate Cycles,” February 22, 2022

4Goldman Sachs: “Will the US Go into Recession.” April 19, 2022

5BCA Research: “The Big Bank Beige Book- April 2022” April 25, 2022

6Charles Schwab Market Commentary: “Tight Rope: History’s Lessons About Rate Cycles,” February 22, 2022

7Bloomberg.com: “What Happens to Stocks When the Fed Hikes: A Historical Guide.” March 13, 2022

This commentary is limited to the dissemination of general information pertaining to our investment advisory services and general economic market conditions. The views expressed are for commentary purposes only and do not take into account any individual personal, financial, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources of information deemed to be reliable, but we do not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Past performance does not guarantee future results. Consult your financial professional before making any investment decision.

Diversification is a strategy designed to manage risk but it cannot ensure a profit or protect against loss in a declining market.

The impact of COVID-19, and other infectious illness outbreaks that may arise in the future, could adversely affect the economies of many nations or the entire global economy, individual issuers and capital markets in ways that cannot necessarily be foreseen. The duration of the COVID-19 outbreak and its effects cannot be determined with certainty.