2025 has simply been boring and status quo, right? There’s not much going on in the world or in the headlines. Not! We want to make sure you are awake as you start to read this.

As we anticipated, the amount of news flowing out of Washington on the policy front this year has been staggering. Its nature has been volatile. President Donald Trump’s talk and actions are creating uncertainty in the financial markets associated with various items, ranging from rather dramatic shifts in tariff announcements to aggressive DOGE initiatives to layoffs of U.S. government workers. Currently, these factors and events are shaking the moods of both investors and consumers. In addition, they appear to be impacting both stock price behavior and trends in interest rates in the early goings of 2025.

After surging in 2023 and 2024, returning a total cumulative return of nearly 60%, the S&P 500, through February 2025, is roughly flat from the day following the election on Nov. 5.1 The S&P 500 has declined roughly 1% in price over the last three months, and it declined roughly 5% from the Feb. 19 high. 2 Market momentum has waned, and leadership has shifted. To wit, higher beta risk-on oriented stocks in more growth-oriented sectors of the S&P 500, such as consumer discretionary and technology, have well underperformed this year. The best performers this year have been in the defensive areas of the market, such as in healthcare, staples, utilities and energy. Specifically, on a year-to-date(YTD) basis through the end of February, the usually growing consumer discretionary and technology sectors are down 5.4% and 4.2%; comparable figures for healthcare, staples, utilities and energy are +8.4%, +7.9%, +4.7%, and +6.1%, respectively. 3 Similarly, in a complete reversal from 2023 and 2024, growth stocks have well underperformed value stocks so far in 2025 and the Mag 7 stocks as a group have generated negative returns and well lagged the “other 493” stocks in the S&P 500. According to surveys compiled by the American Association of Individual Investors, the percentage of stock investors who are bearish has skyrocketed quickly to a level above 60%; folks haven’t been this bearish since the trough in 2022.4 The wall of worry seems to be adding bricks every day.

Are these observations catastrophic? Do they necessarily bode poorly for stock returns for the rest of 2025? Absolutely not. Interestingly, high bearish sentiment tends to be a contrarian positive for stocks. Notice, we said that the last time it had been this negative was at the trough of the market in 2022. When many were the most depressed, the market began to soar.

It is understandable that the market would pause and lose some momentum at this point after two stellar years in 2023 and 2024. The 5% drawdown in the market, from the Feb. 19 high cited above, is quite normal and well below the average annual correction of 14% the S&P has regularly experienced annually. 4 It is quite normal for the S&P 500 to pause in the first 60-90 days following inauguration day, historically. Further, while we have seen some softer fundamental news recently, the fundamental, valuation and technical data, as a whole, remains supportive in our view.

That said, the shift in momentum, sentiment and leadership is not to be ignored and is worth a notice. This is not the time to become complacent.

So, what is our take on all this? Key points are as follows:

- We have differed from many of the strategists on the street in the last two years and continue to do so in 2025. Interestingly, this year as we are starting to remove our rose-colored glasses, many are just now putting them on. We are in the middle of the pack in the strategist community this year on our S&P 500 price target. We are more sober about the magnitude of returns this year versus the prior two and envision far higher market volatility this year than that which investors experienced in the past several years. We would not be surprised to see intermittent pullbacks in the 10% to 15% or greater range. Also, while most were looking for a great first half and a fade in the second half going into this year, we expect the opposite patterns of returns.

- Skeptical of the skeptics. The more bearish prone than us point to disappointing economic data of late, not just to the obvious wall of worry items out of Washington. These tend to be the folks who have been bearish and calling for recession for two years running. Specifically, they might highlight declines in the consumer sentiment and consumer confidence data, a very weak monthly retail sales report in January, the modest uptick in unemployment claims in late February and the recent significant rise in imports resulting from U.S. companies’ efforts to front-run tariff levies and hoard inventory in advance—this negatively impacts real GDP growth, at least temporarily. Once again, we think it important to dive a bit below the surface and not react to the headlines in knee-jerk fashion. The report on retail sales was influenced by horrible weather on many fronts such as fires and snowstorms.

- Consumer confidence and sentiment data are fascinating, but they are heavily influenced by demographics. In these surveys, approximately half the country expects inflation to average 0% over the next five years and economic growth to soar while the other half expects inflation to surge by 5% annually and fears recessionary conditions. As in most things in life, the truth is probably somewhere in between and quite healthy based on what we see. In positive fashion, interest rates have stabilized and retreated a bit. Falling treasury and mortgage rates should help serve as support to spending and to the market. Both manufacturing and capital spending data, especially on AI infrastructure, are trending well. Again, best to reserve judgement at this juncture.

- What About that Wall of Worry (WOW)? Yes, WOW issues including tariff considerations, potential deportation scenarios, government staff reductions and federal deficits will create air pockets. But as in most instances, we think final outcomes on these fronts will be adequately managed and are likely to be resolved in better than feared fashion. When the headlines hit the wire, investors expect nuclear meltdowns; they usually result in bicycle accidents and rally from the temporary swoon inspired by the news. We’ve studied these WOW items and the ever-changing signals/messaging around them and suggest that investors channel Walt Whitman on these fronts for now, which means “Be curious, not judgmental.”

- We have time to evaluate the facts as they evolve. A ready-aim-shoot mentality will be much more productive in managing wealth in this environment than a chaos-ridden, ready-shoot-aim approach. The recent chaos surrounding the announced Feb. 1, 2025, 25% tariffs that were to be levied broadly on imports from Canada and Mexico serve as a great example. At 9 a.m., they were a sure thing to be employed; by afternoon, they were deferred when both countries made concessions, and the Trump administration took the resulting off ramp to delay things. Patience is critical prior to making portfolio adjustments. If these issues are to truly have impact, we will pick that up in the fundamental data: trends in economic growth, inflation, rates, earnings and credit spreads. We take our queues from these metrics NOT from speculative headlines. At present, while there are some yellow flags, the mosaic is still constructive.

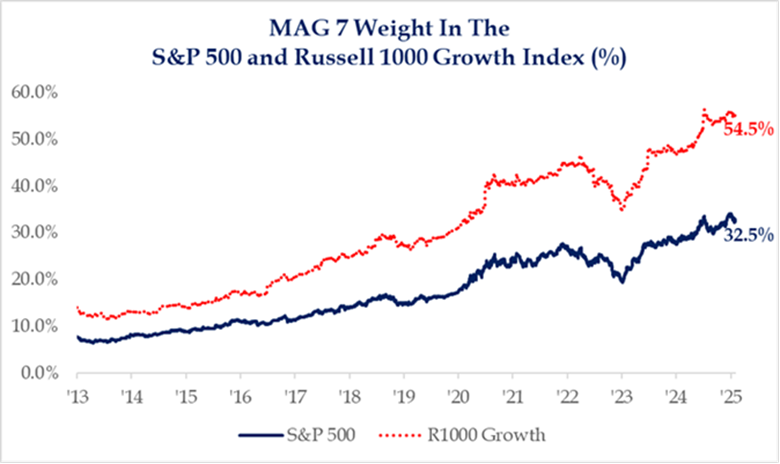

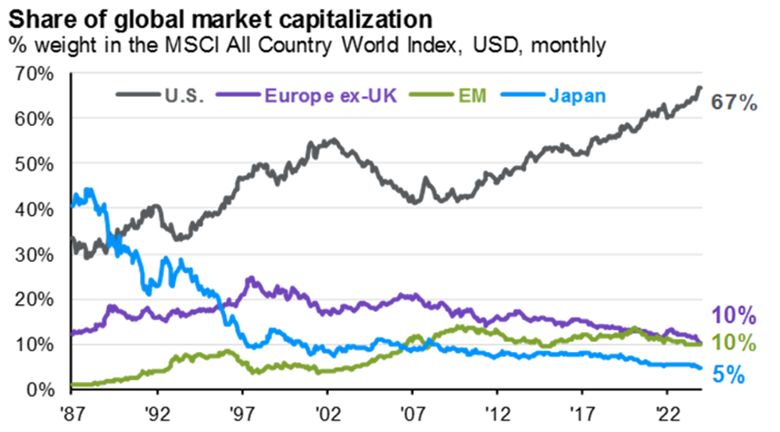

- Time to be aware of portfolio imbalances that have accumulated in the last two years. The passive, market-cap weight S&P 500 index has become a concentrated, high-risk index. There’s too much growth stock exposure in a handful of names; be careful in this index. Our internal equity strategies own these names, but we have much less weight dedicated to them than what resides in such indices as the S&P 500 and Russell 1000 Growth. We own these stocks, but in much more diversified fashion. As depicted in the charts below, the largest seven stocks represent almost a third of the value of the S&P 500 and more than half of the value of the Russell 1000 Growth index. This concentration is concerning. This is a time to balance risk and return considerations. It’s a great time to be an active manager! Also, if you don’t have any international exposure, consider some. U.S. large cap stocks represent a record high level of 67% of global stock market value, up from only 40% several years ago. This also is extreme. This suggestion to diversify is coming from a firm that has maintained a domestic U.S. bias for some time. Remember, an active manager approach (versus passive one) in international equity markets can be very productive.

Source: Strategas

Source: J.P. Morgan Guide to the Markets December 31, 2024

- Our theme for the equity markets is “Expect Clear Air Turbulence in 2025” or CAT. The 2025 stock market experience seems to be consistent with this theme so far. In aviation, CAT is characterized by extremely high winds that happen in clear blue skies at high altitude. It isn’t fatal, but it causes damage. Successful navigation through it is based on the performance of skilled pilots and good communication. Passengers get to their final destination and either enjoy their vacation or execute on their business trip mission, but they are white knuckled on the flight and kiss the ground when they arrive safely to their intended destination. In that vein, we continue to target 6600 for the S&P 500 price level at year end, which is roughly a 12% price return for 2025. However, we expect the market to hit plenty of air pockets throughout the year and for investors to have plenty of uncomfortable moments throughout.

- The fundamental data in the economy and financial markets remains blue sky in nature, but headline wall of worry items such as policy out of Washington in many forms, continued speculation about what the Federal Reserve should/will do and geopolitics will create plenty of turbulence. And, when the market is trading at close to 22 times earnings, there’s not a lot of cushion or safety net for investors to calmly absorb a mere monthly economic or quarterly earnings report that isn’t perfect or exactly as expected. All this said, when the plethora of the data or the broad fundamental mosaic reveals that the economy is still expanding, earnings are still growing nicely, inflation and rates are indeed settling in at expected and normal ranges, the S&P should return to normal altitude from the air pocket drops and go on to achieve our 6600 price target at year end.

Wrap Up

We embrace the old hunter’s adage, “If you don’t know, don’t shoot.” The hunter’s mindset carries some wisdom with it. If you can’t clearly see your target, do nothing. Hold your ground for a better line of sight. Someone gets hurt in the forest if you are impatient.

During this period of transitions in the economy and financial markets:

- We recommend holding your ground on asset allocation at normal levels.

- Be aware of portfolio imbalances that may have accumulated and adjust appropriately. In our internal equity strategies, we are making tactical adjustments congruent with the environment and trend.

- Consider income generating and risk reduction strategies to complement your portfolio—alternatives such as structured notes and option overlay strategies may be helpful, particularly to folks more nervous.

Sources:

1, 2,3,5 FactSet

4 https://www.aaii.com/sentimentsurvey/sent_results

This commentary is provided for informational and educational purposes only. As such, the information contained herein is not intended and should not be construed as individualized advice or recommendation of any kind.

The opinions and forward-looking statements expressed herein are not guarantees of any future performance and actual results or developments may differ materially from those projected. The information provided herein is believed to be reliable, but we do not guarantee accuracy, timeliness, or completeness. It is provided “as is” without any express or implied warranties.

Mag 7 stocks refer to Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

The S&P 500 is a capitalization-weighted index designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. For specific information and definitions on the S&P 500 sector indices, please visit https://www.spglobal.com/spdji/en/landing/investment-themes/sectors/. The Russell 1000 Growth Index measures the performance of the large cap growth segment of the US equity universe. The MSCI ACWI index includes large and mid-caps stocks across 23 Developed Markets and 24 Emerging Markets countries. With 2,645 constituents, the index covers approximately 85% of the global investable equity opportunity set. The indexes referenced herein are unmanaged and cannot be directly invested in.

Equity securities are subject to price fluctuation and investments made in small and mid-cap companies generally involve a higher degree of risk and volatility than investments in large-cap companies. International securities are generally subject to increased risks, including currency fluctuations and social, economic, and political uncertainties, which could increase volatility. These risks are magnified in emerging markets.

Fixed-income securities are subject to loss of principal during periods of rising interest rates and are subject to various other risks including changes in credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors before investing. Interest rates and bond prices tend to move in opposite directions. When interest rates fall, bond prices typically rise, and conversely, when interest rates rise, bond prices typically fall.

Alternative investments as mentioned herein are not appropriate for all investors and investing in alternatives is generally speculative, may involve a greater degree of risk than traditional investments including limited liquidity and limited transparency, among other factors and should only be considered by investors with the financial capability to accept the risk of loss.

There is no assurance that any investment, plan, or strategy will be successful. Investing involves risk, including the possible loss of principal. Past performance does not guarantee future results, and nothing herein should be interpreted as an indication of future performance. Please consult your financial professional before making any investment or financial decisions.

Investment advisory services are offered through Investment Adviser Representatives (“IARs”) registered with Mariner Independent Advisor Network (“MIAN”) or Mariner Platform Solutions (“MPS”), each an SEC registered investment adviser. These IARs generally have their own business entities with trade names, logos, and websites that they use in marketing the services they provide through the Firm. Such business entities are generally owned by one or more IARs of the Firm, not the Firm itself. For additional information about MIAN or MPS, including fees and services, please contact MIAN/MPS or refer to each entity’s Form ADV Part 2A, which is available on the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Registration of an investment adviser does not imply a certain level of skill or training.

Material prepared by MIAN and MPS.