Advanced Planning

Building a Financial Plan to Guide Your Decision Making

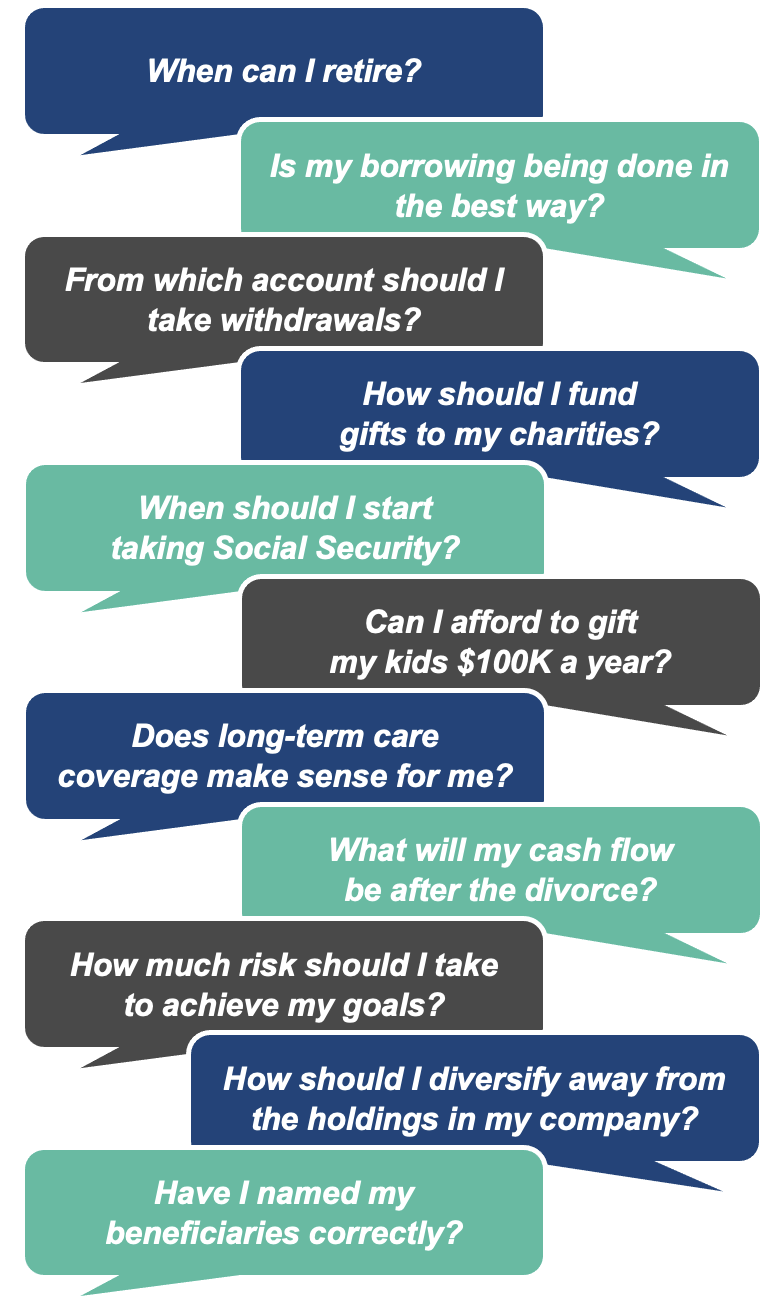

We work with clients who are at a wide range of life’s mileposts. For some, their financial plan is well-defined. For others, we help build their plan.

- Organizing the data. Our process begins with organizing the key data on assets and liabilities to build a personal “balance sheet” and “income statement” – just as any business does. We do a complete review to ensure there are no gaps in your asset protection, liability management, estate structure, cash flows, or insurance coverage.

- Identify goals and develop customized roadmap. After identifying your goals, we construct probability-based outcome scenarios using Monte Carlo simulations that enable real-time tracking of progress toward goals including reporting, scenario stress-testing and analysis of liquidity and multigenerational estate flows.

- Review asset location and income planning. Matching investment vehicles to the right accounts and sequencing income to meet your cash flow can help maximize after-tax dollars for spending or gifting.

- Consider taxes. Many financial decisions have important tax elements. In conjunction with your tax advisor, we help chart tax-efficient paths for your investing, saving and giving plans.

- Monitor continuously. Life brings change, so financial plans can never be a matter of “set it and forget it.” With the data and a plan in place, we can monitor progress toward your goals, identifying elements of the plan that need to be adjusted.

Contact

Us

If you would like to discover how to reimagine your financial journey, complete this form, and we'll be in touch with you soon.

Address

660 Newport Center Dr., #220

Newport Beach, CA 92660

Phone

949.715.2126 office