Exec Summary. Following eighteen months of an investor friendly market environment, 2022 has been a challenging year for investors This year’s first half, through the end of June, saw weak equity returns with the S&P 500 down 20.0% and the NASDAQ down close to 30%. The primary driver for equity weakness was rising interest rates as the Federal Reserve sought to dampen spiking inflation. While bonds typically provide a cushion to equity declines, the rise in rates triggered a near 10% decline in the U.S. bond index as well. International stocks fared slightly worse than the U.S. markets. In general, equity portfolios with a focus on quality and dividends which we emphasize at Ocean Heights, performed significantly better than the market averages.1 Looking forward, we think that inflation is very near a peak and that Federal Reserve rate hikes may give way to more accommodative monetary policy by early next year. If we are approximately right in this view, the anticipatory character of equity markets could set up for a good finish to the year.

Thankfully, the first half is in the books

Entering this year, investment strategists were generally optimistic, viewing the strengths of the U.S. consumer and economy as sufficient bulwarks against expected Federal Reserve interest rate increases. However, the prospect that a significant portion of inflation would prove “transitory” was overwhelmed by the inflationary effects of the war in Ukraine on energy and food prices, and China’s COVID lockdowns’ impact on supply chains. With the 8.6% May inflation print, hopes that inflation might have peaked were dashed. The Fed capitulated to the data reality, and what had been expected to be a 50-basis point June rate hike became a 75-basis point hike – the largest rate hike since 1994.

In response, the S&P 500 fell 9% in a single week, closing out the year’s first half down 20.0% for the worst first half in over 50 years. The NASDAQ was down 29.5%, and many speculative holdings were down 50% or more. While bonds typically provide ballast to portfolios during equity declines, the S&P U.S. Aggregate Bond Index fell 9.6% in the first half due to rising rates. Almost all foreign markets fell more than the major U.S. indices as they struggled against the headwinds of a strong U.S. dollar and slowing global growth.

Recession fears

The weak close to the second quarter was driven largely by a sharp rise in recession fears. It seemed that a majority of media talking heads viewed a recession as a given. Consumer sentiment hit a 40-year low, and even rapper Cardi B was tweeting about a coming recession.

Nevertheless, careful observers such as Goldman Sachs’ highly respected economics team have put the probability of recession before the end of 2023 at under 50%. First, they note that the tight labor market gives the Fed potential room to tighten policy to where companies in aggregate defer hiring and expansion plans without actually having to fire workers. Second, they point to consumer strength as evidenced by consumer balance sheets, debt service levels, and spending trends, a view reinforced in many CEO interviews. Although consumer sentiment has been plumbing multi-year lows, it is important to distinguish between survey measures and actual behavior. Consumers may hate high gasoline prices, but with robust bank accounts and balance sheets, spending has remained strong, and companies have generally been able to pass along their higher input costs, at least thus far.

Although it is difficult to predict if and when we will see a recession, the risk is clearly rising. Most of the recent economic data have been coming in below expectations. Longer term rates have fallen since mid-June (see chart), and the yield curve has inverted which historically has been one of the most accurate predictors of recession. In the end, the outcome on recession will likely be shaped by the path of inflation and how hard and long the Fed tightens monetary policy.

Inflation

Inflation is one of the most politically charged economic issues, especially when it exceeds wage increases as has been the case this year. Hence, the Fed is under intense pressure to lower inflation. However, the Fed’s task is challenged by the fact that a significant part of the current problem is supply constraints. Higher interest rates can damp demand, but they won’t create more oil, more wheat, or more workers.

Some prognosticators began calling “peak inflation” in May, but reported inflation data have not yet peaked, with the CPI for June coming in at 9.1% Some significant components of inflation which tend to change slowly, viz. shelter and wages, are still rising.

Nevertheless, there are reasons to believe that we are very close to inflation’s peak. First, commodities, oil, and long interest rates have fallen, as have indicators of supply chain stress such as shipping rates. Second, history shows that inflation spikes usually last only 2-3 years as shown in the following chart for U.S. inflation over the last 100 years.

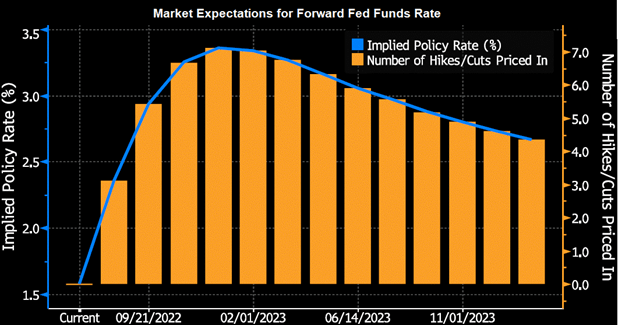

In fact, forward inflation expectations have already fallen sharply. The current 5- and 10-year inflation break-evens (market-derived measures of expected future inflation) are lower than they were a year ago. As shown in the chart below generated by Bloomberg’s WIRP function, as of 7/23/22 the market expects the Fed policy rate to peak below 3.5% early in 2023 and then decline as the Fed begins cutting rates.

Equity Valuations & Earnings Outlook

With the rise in interest rates during the first half, the forward earnings multiple for the S&P 500 fell from 22 at the turn of the year to 15.9, below the 25-average of 16.8.2 However, earnings are forecast to grow at 10% over the next year3, a rate that seems at odds with headwinds from slowing growth, rising rates, and wage pressures. In addition, the surging U.S. dollar is depressing the foreign earnings of U.S. exporters.

As of this writing, Q2 earnings reported to date are proving surprisingly solid. Companies generally seem to have had the pricing power needed to pass along their higher input costs. But earnings guidance for the second half of the year has been more concerning. Even if we don’t see an economic recession, we could see a “profits recession” if second half earnings disappoint.

Catalysts For a Sustained Market Improvement

Recent volatility has been elevated with sharp declines and advances. While July has seen the equities up month to date, we doubt that we yet have the conditions for a sustained market advance in place. Catalysts for such which we will be looking to see include:

- Less bad inflation data. Equities will benefit when inflation data suggests that Fed monetary policy is likely to become less tight than what is priced in.

- Resilient economic and earnings data. While we expect the economy and earnings to weaken further, the market respond better to moderate weakening than something more severe.

- Investor capitulation. Major bottoms are usually accompanied by signs of investor capitulation. We are starting to see some of those signs as noted in the Bank of America July Fund Manager Survey which showed extreme lows in equity exposure and highs in cash.

- Dollar weakness. Recent dollar strength has been a headwind for equities. While dollar strength can be either bullish or bearish, in the current context we believe that equities would be favored by a weakening dollar.

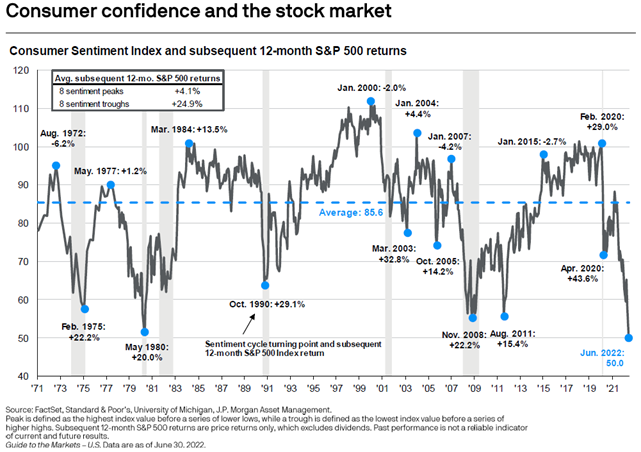

When the market does begin a sustained advance, consumer and investor sentiment are likely to still be poor. In fact, nadirs in consumer sentiment have historically been good entry points with much better forward returns as compared to periods with strong consumer sentiment as shown in the chart below.

If inflation and the Fed policy response play out similarly to the timetable reflected in the chart on the prior page – there is no guarantee that they will – the anticipatory character of equity markets could mean a good setup for Q4. This would also coincide with the historical pattern of strong Q4s in election years.

Portfolio strategy

One of Warren Buffet’s oft-quoted remarks is “Only when the tide goes out do you discover who has been swimming naked.” This comment is especially apt this year with so many high multiple growth and “story” stocks having gotten clobbered. As clients know, our equity investment approach is focused on seeking to identify quality companies trading at reasonable valuations which have shareholder-friendly capital allocation practices, e.g., dividends. This market approach has worked especially well this year when looking at market returns.4

At this time, we don’t feel a need to make strategic changes to portfolios. However, the market decline has made it easier to opportunistically switch into stocks we view as upgrades to current holdings, and we will continue to search for such tactical opportunities. As to fixed income, the rise in rates has lowered the value of most holdings, but it has also increased the yields now available. If our outlook for lower growth and a more accommodative Fed ahead proves out, we may now be at a good spot for putting cash to work in fixed income and upping duration.

For those with cash available, we expect to see good entry points for equity markets in the coming months and are currently employing strategies to cautiously work into the market. We will watch our signals for guidance, but with no expectation that we will catch the market bottom. While there is a higher degree of uncertainty than usual in 2022, for investors with multi-year time horizons we remain focused on holding stocks of good companies and exposure to areas of the market and assets that are likely to perform well through full market cycles – the best path to long-term investment success in our view.

As always, if you have questions about how our current views affect your financial plan or investment strategy, please do not hesitate to reach out to your advisory team.

Sources:

1, 4 S&P 500 Quality High Dividend Index -5.57% and the S&P 500 Index -17.03% YTD as of 7-26-22 – total return.

2 JP Morgan Asset Management “3Q-2022 Guide to the Markets,” data as of 6-30-2022.

3 Refinitiv IBES as reported by BCA Research, July 25, 2022.

This commentary represents an assessment of the market environment as of July 27, 2022. The views expressed may change based on the market or other conditions.

Market indices referenced herein are unmanaged and are not available for direct investment. Past performance is no indication of future results. Investing involves risk and the potential to lose principal.

This is provided for informational and educational purposes only and does not consider any individual personal, financial, legal, or tax considerations. As such, the information contained herein is not intended to be personal legal, investment, or tax advice or a solicitation to buy or sell any security or engage in a particular investment strategy. Nothing herein should be relied upon as such, and there is no guarantee that any claims made will come to pass. Any opinions and forecasts contained herein are based on information and sources deemed to be reliable, but we do not warrant the accuracy of the information that this opinion and forecast is based upon. You should note that the materials are provided “as is” without any express or implied warranties. Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. Consult your financial professional before making any investment decision.

Investment advisory services are provided through Mariner Platform Solutions, LLC (“MPS”). MPS is an investment adviser registered with the SEC, headquartered in Overland Park, Kansas. Registration of an investment advisor does not imply a certain level of skill or training. MPS is in compliance with the current notice filing requirements imposed upon registered investment advisers by those states in which MPS transacts business and maintains clients. MPS is either notice filed or qualifies for an exemption or exclusion from notice filing requirements in those states. Any subsequent, direct communication by MPS with a prospective client shall be conducted by a representative that is either registered or qualifies for an exemption or exclusion from registration in the state where the prospective client resides. For additional information about MPS, including fees and services, please contact MPS or refer to the Investment Adviser Public Disclosure website (www.adviserinfo.sec.gov). Please read the disclosure statement carefully before you invest or send money.

Investment Adviser Representatives (“IARs”) are independent contractors of MPS and generally maintain or affiliate with a separate business entity through which they market their services. The separate business entity is not owned, controlled by, or affiliated with MPS and is not registered with the SEC. Please refer to the disclosure statement of MPS for additional information.